How Can an Intellectual Property Budget Be Accurately Estimated?

Challenges Involved in Predicting the Costs of Obtaining and Maintaining an Intellectual

Property Portfolio and How Technology Can Aid in Overpowering Such Challenges

By Anthony de Andrade (President and CEO, Quantify IP) & Venkatesh Viswanath

(Senior Analyst, Quantify IP)

February 14, 2018

2

EXECUTIVE SUMMARY

Intellectual Property is the undisputed buzzword in the business world. From being a luxury to a

necessity, the manner in which companies view Intellectual Property has witnessed a revolutionary

reversal over the last four decades.

However, given the complexities and the uncertainties involved, developing an Intellectual

Property strategy for a given budget or estimating a budget for a given Intellectual Property

strategy can be a notoriously hard task that is bound to give sleepless nights even to the most

seasoned of professionals.

There are four main considerations in budgeting for Intellectual Property: official fees, attorney

charges, translation costs, and ‘In-House’ fees. These, in turn, are spread across the different stages

of the Intellectual Property lifecycle: filing, examination, prosecution, grant, and annuities.

Traditional methods of estimating an Intellectual Property budget, which include the “guesstimate”

approach and forging partnerships with law firms to offer their services at a capped-fee structure,

can result in a high variance of 10% to 20% between the budgeted spend and the actual spend.

Thus, state-of-the-art tools that provide accurate worldwide Intellectual Property costs are the need

of the hour. This is precisely where Quantify IP fits in. The company’s suite of unique and

proprietary software programs has been powering corporations to successfully manage their

Intellectual Property budgets. As a result, in-house counsels no longer need to fret about providing

a ballpark budget figure to the Chief Financial Officer. The figure can be generated instantly at the

click of a mouse. It’s as easy as that!

3

TABLE OF CONTENTS

1. WHY IS AN ACCURATE INTELLECTUAL PROPERTY BUDGET REQUIRED? ....................... 4

2. WHY IS INTELLECTUAL PROPERTY BUDGETING COMPLEX? .............................................. 4

3. INTELLECTUAL PROPERTY BUDGETING: KEY CONSIDERATIONS ..................................... 5

3.1. OFFICIAL FEES .......................................................................................................................... 5

3.2. ATTORNEY/ASSOCIATE CHARGES ...................................................................................... 6

3.3. TRANSLATION COSTS ............................................................................................................. 6

3.4. IN-HOUSE FEES ......................................................................................................................... 6

3.5. EXAMINATION .......................................................................................................................... 6

3.6. PROSECUTION ........................................................................................................................... 7

3.7. GRANT/REGISTRATION/ISSUE/ALLOWANCE .................................................................... 8

3.8. ANNUITIES AND TIME-TO-GRANT ....................................................................................... 8

3.9. THERE IS MORE TO PATENT RENEWALS THAN MEETS THE EYE ................................ 8

4. TRADITIONAL METHODS OF INTELLECTUAL PROPERTY BUDGETING ............................. 9

5. STATE-OF-THE-ART TOOLS FOR INTELLECTUAL PROPERTY BUDGETING ...................... 9

5.1. THE GLOBAL IP ESTIMATOR ............................................................................................... 10

5.2. THE PORTFOLIO ESTIMATOR - PATENTS ......................................................................... 11

5.3. THE PORTFOLIO ESTIMATOR - TRADEMARKS ............................................................... 11

5.4. THE GLOBAL IP STRATEGIZER ........................................................................................... 12

6. HOW CHEVRON PHILLIPS WON THE BATTLE: A CASE STUDY ........................................... 13

6.1. THE COMPANY ........................................................................................................................ 13

6.2. THE CHALLENGES .................................................................................................................. 13

6.3. THE SOLUTION ........................................................................................................................ 13

7. CONCLUSION ................................................................................................................................... 14

8. FIGURES ............................................................................................................................................ 15

4

1. WHY IS AN ACCURATE INTELLECTUAL PROPERTY BUDGET REQUIRED?

In today’s knowledge-based global economy, businesses are constantly faced with the challenge

of having to think outside the box to be innovative in order to survive. This cycle of constantly

innovating and creating new products has resulted in a huge accumulation of intangible assets

within businesses, with the last four decades having witnessed a revolutionary reversal in the

proportion of tangible to intangible assets that make up the corporate balance sheet. The proportion

of intangible assets, which was about 20% on average in the late 1970’s, has now risen to meteoric

heights and stands at about 80%. A study of the intangible assets of the ‘Standard & Poor’s 500’

companies conducted by an Intellectual Property financial services company in 2015 estimated the

proportion of intangible assets to be around 87%.

Though the need for companies to innovate is greater than ever before, shrinking budgets have

turned the spotlight to cost-effective innovation and Intellectual Property protection strategies. In

fact, as per a survey conducted by a foreign filing service provider, one-third of polled in-house

Intellectual Property counsels reported a budget cut in 2016, with a significant reduction of over

30% being reported by approximately 20% of the respondents. Thus, the mandate from the C-Suite

seems to be loud and clear: ‘Achieve more with less.’

In light of the above, accurate estimation of an Intellectual Property budget for strategic decision-

making has become a critical necessity for Intellectual Property law firms and in-house Intellectual

Property counsels, especially for those dealing with a large portfolio of Intellectual Property

families. However, this is easier said than done. This was proved in a recent Budgeting and

Forecasting study conducted among corporate counsels by an Intellectual Property management

company, which found Intellectual Property budgeting to be a time-consuming and complex task.

2. WHY IS INTELLECTUAL PROPERTY BUDGETING COMPLEX?

The major complexity in Intellectual Property budgeting stems from the territorial nature of

Intellectual Property, which, in turn, makes budgeting an onerous task. Rapid globalization has

turned the world into a global village, with many businesses having a pan-global presence.

This, in turn, has led to increased foreign filings. In 2016, the World Intellectual Property

Organization, a specialized agency of the United Nations, reported an approximately 7% year-

over-year increase in international patent and trademark applications filed under the Patent

Cooperation Treaty (PCT) and the Madrid System, respectively. Likewise, the agency also

reported a 35% growth in international design applications filed under the Hague System.

Despite the increased foreign filings and the presence of an international body, there is a lack of

harmonization among Intellectual Property laws, with the concept of “International Intellectual

Property” protection being a myth that, sadly, does not exist. As a result, protecting Intellectual

Property in multiple jurisdictions requires skillful navigation through a labyrinth of national and

regional legislations, each mandating a unique set of procedures from filing through grant and

beyond. Further complexities arise from the specific foreign filing strategies used (e.g. PCT v.

5

Paris Convention; Madrid System v. Paris Convention; Hague System v. Paris Convention; or

Regional Intellectual Property Offices v. National Intellectual Property Offices, to name a few).

3. INTELLECTUAL PROPERTY BUDGETING: KEY CONSIDERATIONS

An Intellectual Property budget is like a complex jigsaw puzzle; fitting the pieces together may be

challenging even for the most experienced of professionals. There are four main considerations:

official fees, attorney charges, translation costs, and ‘In-House’ fees. These, in turn, are spread

across the different stages of the Intellectual Property lifecycle: filing, examination, prosecution,

grant, and annuities (also known as annual fees/renewal fees/maintenance fees).

3.1. OFFICIAL FEES

An official fee refers to a prescribed fee that is charged by a National Intellectual Property Office

(or a National Patent and Trademark Office) of a particular jurisdiction for one or more services

in relation to Intellectual Property filing and registration.

For patents, the official fees to be paid to a National Patent Office for a patent application depend

on a myriad of variables, such as the:

Mode of filing (electronic v. paper) (Figure 1);

Type of applicant;

Number of pages and the number of claims/independent claims in the specification (Figure

2);

Number of pages of sequence listings (for biotechnology inventions);

Number of countries designated;

Number of priorities claimed; and

Chosen International Searching Authority and the International Preliminary Examining

Authority (if examination is opted for) under the PCT.

The mode of filing can have a profound impact on the total filing fees, with many National Patent

Offices offering incentives to file electronic applications (‘Go Green’ initiatives). For instance, the

Japan Patent Office charges a basic fee of 1,200 Japanese Yen (~11 U.S. Dollars) for rewriting

data into electronic format, along with an additional fee of 700 Yen per sheet (~6.5 U.S. Dollars).

Among the top jurisdictions, the State Intellectual Property Office (China), the Indian Patent

Office, and the European Patent Office charge fees for excess claims and excess pages (beyond 30

pages and 10 claims in both China and India, and beyond 35 pages and 15 claims in Europe).

Likewise, in addition to the mode of filing, the type of applicant, the number of priorities claimed,

and the number of countries designated, the official fees to be paid to a National Trademark Office

also depend on the number of classes of goods and services that have been specified in the

application. As per the Nice Classification (‘International Classification of Goods and Services’),

there are 34 classes for goods and 11 classes for services. Usually, corporations try to protect their

trademarks in as many related classes as possible, and, thus, the costs go up accordingly.

6

3.2. ATTORNEY/ASSOCIATE CHARGES

An attorney charge refers to a charge levied by a legal representative handling an Intellectual

Property application in a particular country. Most attorneys/patent agents/trademark agents work

on an hourly basis, and their fee schedules may not be readily available.

Further, the fee schedules of attorneys are usually structured along the lines of the official fees’

schedules of National Intellectual Property Offices, which is why attorneys often charge for

handling additional claims and additional pages beyond the limit that is covered under the basic

filing fee. These charges can be quite high and may constitute a significant proportion (50% to

75%) of the total filing costs in jurisdictions, such as China and India.

3.3. TRANSLATION COSTS

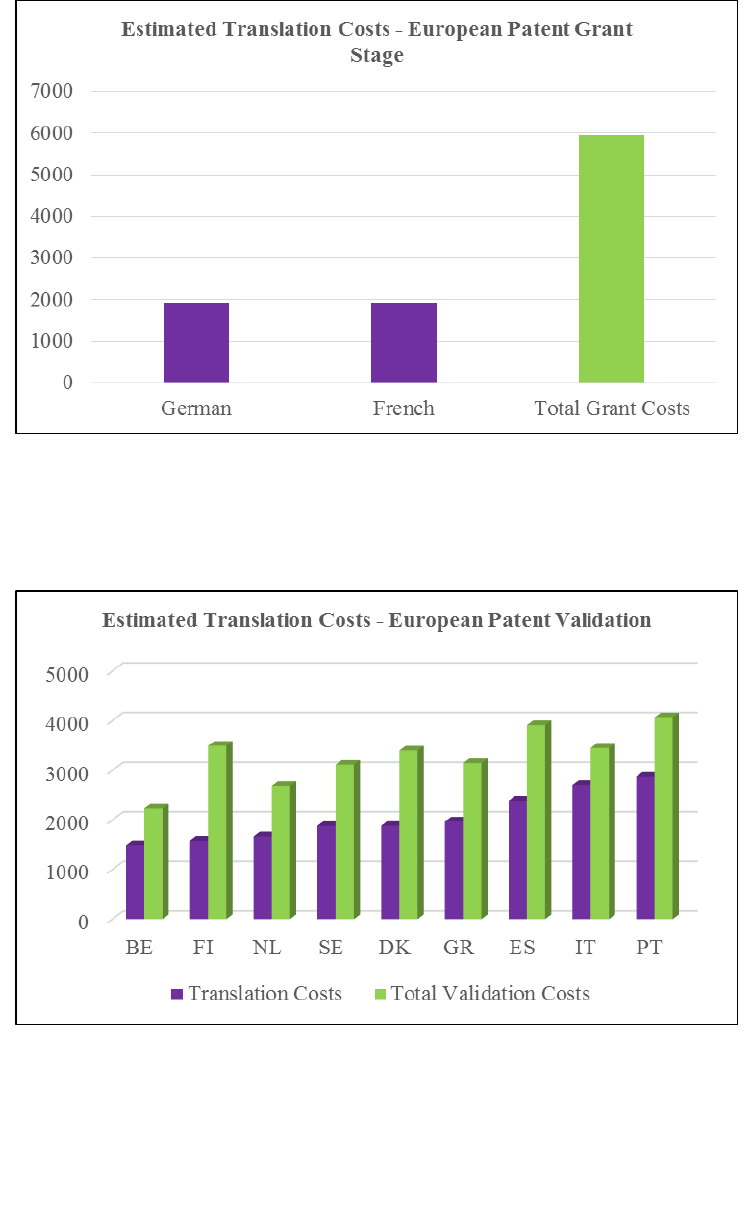

Translation costs may be incurred in several circumstances. The first is when filing a patent (Figure

3)/trademark application (i.e. the description of goods and services) or prosecuting a patent

application (Figure 4) in a jurisdiction in which English is not an official language.

The second instance is at the time of grant of a European Patent (Figure 5). The European Patent

Office has three official languages (English, French, and German), and the European Patent

Convention mandates a translation of the claims at the time of grant into two of the official

languages (other than the language in which the proceedings for the patent application took place).

The third instance in which translation costs may be incurred is at the time of validating a European

Patent, which is a bundle of “individual National Patents” in member states of interest. This

process may involve translation of only the claims or the entire specification (Figure 6). Ever since

the London Agreement came into force, eight member states have entirely dispensed with their

translation requirements at the time of validation: France; Germany; Ireland;

Liechtenstein; Luxembourg; Monaco; Switzerland; and the United Kingdom.

Translation costs incurred on patents may constitute a huge proportion of the total costs; the

estimated costs of translating a patent application into Chinese, Japanese, Korean, and Russian

may constitute approximately 65% to 80% of the total filing costs (Figure 3). Likewise, the

estimated translation costs at the time of prosecuting a patent application may constitute 40% or

more of the total prosecution costs in some jurisdictions (e.g. Japan, China, Ukraine, and

Kazakhstan).

Like the fee schedules of attorneys, the fee schedules of translators, who usually work either on a

“per word” basis or on a “per page” basis, may also not be readily available.

3.4. IN-HOUSE FEES

An In-House fee refers to a fee charged by an attorney in an applicant’s ‘Home Country’ and is

generally applicable to foreign filings outside the applicant’s Home Country.

3.5. EXAMINATION

7

Examination is an integral part of the process of obtaining or registering Intellectual Property and

involves a formal examination and a substantive examination (where applicable).

There are two types of patent examination systems across the world: automatic examination and

deferred examination. In the former, as the name implies, a patent application is automatically

taken up for examination based on the date of publication, which, in turn, depends on the date of

filing or the priority date. Israel and the U.S. are examples of jurisdictions with automatic

examination. In deferred examination, on the other hand, a patent application is generally taken up

for examination on the basis of the date on which an examination request is filed. Many

jurisdictions, including the European Patent Office, China, Japan, and South Korea, mandate the

deferred system of examination, in which an explicit deadline is specified for filing the

examination request. This deadline is often in the range of three to five years from the date of

filing, the date of priority, or the international filing date (as the case may be).

It is also pertinent to note that the number of claims (Japan and South Korea) or the number of

independent claims (Russia) in a patent specification may have a notable impact on the fee to be

paid at the time of requesting an examination.

Trademarks and designs are normally taken up for examination on an automatic basis, with a few

jurisdictions following a deferred system of examination for designs.

In jurisdictions with a deferred system of examination, an attorney charge will be incurred for

filing the request for examination; this charge may be waived if this request is filed at the time of

filing an application.

3.6. PROSECUTION

The term “prosecution” refers to the interactions between an applicant and a National Intellectual

Property Office with regards to either an Intellectual Property application (pre-grant prosecution)

or a granted Intellectual Property (post-grant prosecution).

Prosecution is especially applicable to patents and to jurisdictions that conduct a substantive patent

examination. While both pre-grant and post-grant prosecution for patents may involve oppositions

and amendments, pre-grant prosecution also involves office actions (or examination reports)

issued by a National Patent Office, subsequent responses filed by an applicant, and examiner

interviews or hearings (where applicable).

Estimating patent pre-grant prosecution costs can be a Herculean task. These costs may vary

depending on the number of office actions, which, in turn, generally depend on the complexity of

the disclosed invention and the clarity with which it has been drafted. Further, while some

jurisdictions, such as India, Australia, Pakistan, and the United Kingdom have definite timelines

in place for putting an application in order for grant (from the date of filing, the date of priority or

the date of the first office action, as the case may be), such timelines do not exist in many

jurisdictions.

8

3.7. GRANT/REGISTRATION/ISSUE/ALLOWANCE

An Intellectual Property is said to be “ready for grant” once a National Intellectual Property Office

is convinced that there are no outstanding objections to the grant/issue/allowance of a patent or the

registration of a trademark/industrial design. At this stage, some Intellectual Property Offices

invite an applicant to pay a prescribed official fee within a given period of time.

For patents, as is the case with examination, the total number of claims may have an impact on the

fee to be paid. Both Japan and South Korea charge grant fees on a “per claim” basis, while

Australia and Singapore charge for claims beyond 20 claims.

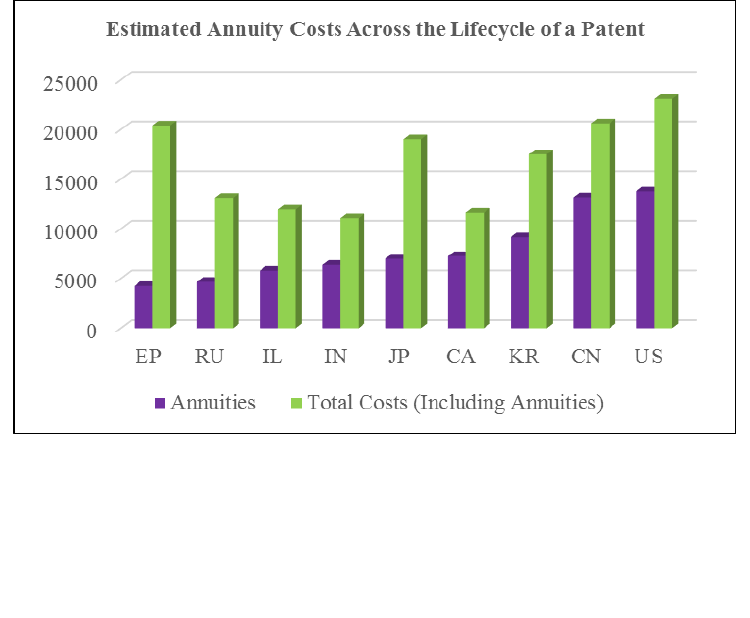

3.8. ANNUITIES AND TIME-TO-GRANT

The term “annuity” (also known as a renewal fee/maintenance fee/annual fee) refers to an official

fee that is to be paid in advance to a National Intellectual Property Office to keep an Intellectual

Property application or a granted Intellectual Property in force for the subsequent year/s.

While the term of a patent is normally 20 years from the date of filing, the international filing date,

or the date of priority (as the case may be), the term of an industrial design may vary between 10

years to 25 years, depending on the jurisdiction. Trademarks, on the other hand, do not have a

definite term and can be renewed indefinitely, with each renewal term usually lasting between 7

years to 10 years. There may also be additional maintenance costs associated with trademarks,

such as the filing of a declaration of use.

The annuities to be paid in respect of a patent application (pre-grant annuities) can be broadly

categorized into two types of systems. In the first type, an annuity is to be paid irrespective of

whether the patent application is pending or a notice of allowance has been issued. In the second

type, on the other hand, annuities are to be retrospectively paid at the time of grant, along with the

patent grant/registration/issue fees (if applicable). The latter, referred to as “accumulated

annuities” or “back taxes” in patent lingo, is advantageous for an applicant since the annuities need

to be paid only if a patent is granted.

Patent annuities have a steep price tag associated with them and can account for a significant

portion of the total costs incurred on a patent over its 20-year lifecycle (Figure 7). Thus, it is

advisable to estimate or model these costs beforehand. However, this can be challenging as the

pre-grant annuities depend on the time taken to grant, which varies from one jurisdiction to

another. Further, even within a particular jurisdiction, the time taken to grant may be dependent

on the complexity of an invention and the field of the invention. Brazil and Thailand, for instance,

take an extremely long time to examine patent applications in the pharmaceutical sciences.

3.9. THERE IS MORE TO PATENT RENEWALS THAN MEETS THE EYE

Last, but not least, it is vital to know whether a firm that has been entrusted with handling

Intellectual Property renewal payments on behalf of a company is charging the right amounts or if

9

there are discrepancies in the provided invoices. Though this seems obvious, it is an often

overlooked aspect that is not given due consideration.

Many patent holders, especially those with large patent portfolios, utilize the services of either

specialized patent renewal firms or Intellectual Property law firms to manage their renewal

payments. Even in the case of the latter, the work may be outsourced to a patent renewal firm, with

or without the knowledge of the patent holder.

Such patent renewal firms may utilize opaque billing practices to systematically overcharge their

clients, as CPA Global, the world’s largest Intellectual Property management company, was

alleged to have done in a U.S. class action lawsuit. The company took the Intellectual Property

community by storm by agreeing to pay $5.6 million to settle the lawsuit out of court (Peter Rouse;

2017).

This incident has brought to the limelight the significance of accurately estimating or modeling

the costs for a patent portfolio beforehand.

4. TRADITIONAL METHODS OF INTELLECTUAL PROPERTY BUDGETING

Traditionally, in-house counsels have relied on a “guesstimate” approach to estimate or model the

current and future costs of a company’s Intellectual Property portfolio. Such an approach is a time-

consuming process that is prone to errors and is fraught with dangers and difficulties. Moreover,

this approach, which may not be the most-effective use of the time of an in-house counsel or

Intellectual Property Manager, may work to an extent only for smaller portfolios. An example of

such an approach is manually collating average data from an electronic invoicing system and a

docketing system into an Excel spreadsheet.

Another approach followed by in-house counsels is to forge partnerships with domestic and foreign

law firms to offer their services at a capped-fee structure.

Despite following such approaches, the variance between the budgeted spend and the actual spend

can still be quite high (between 10% and 20%), which can translate to a fairly high amount of

money for corporations with a multi-million dollar budget.

5. STATE-OF-THE-ART TOOLS FOR INTELLECTUAL PROPERTY BUDGETING

Quantify IP, a company founded in 1984, offers smart, robust, and state-of-the art Intellectual

Property cost estimation solutions which greatly simplify Intellectual Property budgeting.

These solutions facilitate the accurate estimation or modeling of Intellectual Property costs in more

than 150 jurisdictions at the click of a mouse. Since the global Intellectual Property legislative

landscape is dynamic, the company’s research team is constantly reviewing legislations, costs, and

timelines; the software is frequently updated to reflect any changes or amendments in legislations

that they may have found.

10

Fee schedules from a worldwide network of Intellectual Property law firms have been used to build

a highly advanced model, which is used in the calculation of cost estimates. The cost estimates

also include Value Added Tax (where applicable). The 75th percentile of the values found within

the fee schedules supplied by at least five independent associates is used for most jurisdictions.

5.1. THE GLOBAL IP ESTIMATOR

The Global IP Estimator, the first product to be launched from the stables of Quantify IP, predicts

the costs for a single patent (including PCT applications, PCT National Phase applications, EPO

applications, and EPO validations), trademark, utility model, and design family. In other words,

the product is a four-in-one cost calculator (i.e. it can function as a patent cost calculator; a

trademark cost calculator; a utility model cost calculator; and/or a design cost calculator). It is

currently available in two modes: a desktop version and an online version.

This flagship software generates meticulous cost estimates that are split up by stage (an additional

search stage is included for trademarks). The year in which each stage is likely to occur is also

displayed. Four different types of costs are contained within each stage: official government fees;

associate (attorney) charges; translation costs; and in-house/miscellaneous costs.

The prosecution costs are estimated based on research of the average number of prosecution

actions in each jurisdiction.

While calculating annuities, the system takes into account the varying rules by country. Patent

annuities differ from one jurisdiction to another, not only in terms of the fee to be paid, but also

the time and frequency of payment. For instance, some countries may require an annuity fee to be

paid from the first year onwards, whereas the application fee may also include the annuity fee for

a limited number of years in some other jurisdictions.

In jurisdictions where the annuities are accumulated until grant, the annuities to be paid at the time

of grant are estimated based on research of the average ‘time taken to grant’ in each jurisdiction.

Three types of reports can be generated using the Global IP Estimator: a condensed summary

report that provides a quick snapshot of total costs (official, associate, In-House, and annuities)

per country; a summary report (condensed summary report further broken down into totals by

stages); and a detailed report.

An array of customizable features makes the Global IP Estimator user-friendly and easy to use.

These features include:

Setting the values for the above-mentioned cost-influencing variables;

Estimating translation costs based on number of pages or number of words;

Defining associate charges;

Defining a prosecution multiplier to reflect any anticipated difficulty in prosecuting a

patent application (initially set to a value of one);

Including or excluding specific stages of the Intellectual Property lifecycle;

Including or excluding specific categories of costs; and

11

Setting the Receiving Office, Search Authority, Supplementary Search Authority, and

Examining Authority for a PCT application.

5.2. THE PORTFOLIO ESTIMATOR - PATENTS

The savvy Portfolio Estimator - Patents helps take the guesswork out of patent portfolio cost

estimation. Sophisticated algorithms facilitate importation of docketing data from almost any

docketing system. Portfolio data can also be manually entered. Customization with user-defined

groups is an added feature. For example, a report could be summarized by business unit and then

by technology within each business unit.

In addition to the features contained in the Global IP Estimator, the Portfolio Estimator - Patents

generates a wide variety of advanced reports for maximum flexibility. These detailed reports

include: costs for each patent family by country by year; costs by country by year; costs by patent

family by year; costs by stage in each country by year; and costs by category in each country by

year.

The reports from the Portfolio Estimator - Patents can be used to gain precious insights into

possible cost-cutting avenues. For example, a “Detail Cost Analysis” report may prove to be vital

in exploring cutting future costs. It provides a patent/country analysis that details future costs by

year for each patent in each country for the next 20 years.

An “Ungranted Aging” report, which summarizes and details the patent applications that are still

pending beyond a certain number of years after the average time taken to grant for each country,

may assist with the identification of applications that can be abandoned, either because there is a

possibility that they may never be granted or because the disclosed technology has become

obsolete. Strategically abandoning these aging applications can create tremendous cost savings.

An “Expiring Patents” report lists the patent applications that will expire in the next five years,

along with the remaining maintenance costs.

An added feature of the Portfolio Estimator - Patents is ‘Projected Filings’, through which filing

patterns that complement the international filings of Intellectual Property families that have begun,

but are yet to be completed, can be set up, and the costs can be predicted for these probable future

filings.

5.3. THE PORTFOLIO ESTIMATOR - TRADEMARKS

The versatile Portfolio Estimator - Trademarks is the latest, ground-breaking product to be

launched from the stables of Quantify IP and is a powerful tool that precisely predicts the costs of

an entire trademark portfolio.

Like its counterpart for patents (the Portfolio Estimator - Patents), the Portfolio Estimator -

Trademarks also generates a wide variety of advanced reports in both Word and Excel. For

maximum flexibility, these detailed reports include various viewing options: costs for each

trademark family by country by year; costs by country by year; costs by trademark family by year;

12

costs by stage in each country by year; costs by category in each country by year; and costs by

class.

While calculating the renewal costs and dates, the system takes into account the varying rules and

regulations for trademarks around the globe. For instance, in some countries, the renewal date is

based on the registration date, while in some other countries, it is based on the filing date. Renewal

timings also vary by country.

The costs are calculated based on particular attributes of a trademark (such as the number of

classes) that are entered into the system. Analysis can be performed either across an entire

trademark portfolio, or a selected set of trademark families. Further, the defaults can be adjusted

to customize the analysis. Additionally, the costs can be viewed and analyzed by one or more user-

defined groups.

5.4. THE GLOBAL IP STRATEGIZER

The Global IP Strategizer facilitates the modeling of future filing strategy costs of patents, thereby

empowering in-house counsels and Patent Managers to make informed foreign filing decisions.

Specifically, it allows the modeling of costs for planned patent filings that do not have a record in

a docketing system. The invaluable insight gained from the Global IP Strategizer can save time

and money by helping businesses cherry-pick the best filing scenarios.

This tool is especially of use to companies that have an intricate business structure consisting of

various business divisions, with each business division having its own subdivisions. An example

of such a business structure would be a company having two different “Cost Centers” (“Center for

Disruptive Technologies”, and “Center for Incremental Innovations”, for instance) and three

different “Country Groups” (such as “Broadest Coverage”, “Intermediate Coverage”, and

“Minimum Coverage”). In such a situation, six different Cost Center/Country Group combinations

are possible, and each combination could have its own frequency of future filings.

The salient features of the Global IP Strategizer are:

Estimate the precise costs for any number of ‘what-if’ filing scenarios’;

Set the frequency of future filings within each scenario;

Include or exclude PCT Chapter II Demand phase;

Set the Receiving Office, Search, and Examination Authorities for a PCT application; and

Combine multiple scenarios to create a strategy and include abandonment rates within each

strategy.

13

6. HOW CHEVRON PHILLIPS WON THE BATTLE: A CASE STUDY

6.1. THE COMPANY

Chevron Phillips (referred to as "client" hereinafter) is a 50/50 joint venture between Chevron and

Phillips 66. The Texas-headquartered client possesses a varied product portfolio and is "one of the

world's top producers of olefins and polyolefins and a leading supplier of aromatics, alpha olefins,

styrenics, specialty chemicals, piping, and proprietary plastics" (http://www.cpchem.com/en-

us/company/pages/default.aspx; accessed October 2017)

6.2. THE CHALLENGES

The major challenge faced by the client was the inability to estimate patent costs with precision

and efficiency (the client forecasts its budgets four years in advance). There are many different

business units within the client, each with its own unique needs and filing patterns. For instance,

one business division may file new patent applications every year, while another may file a patent

application every five years.

Further, the estimation of foreign portfolio costs was complicated by the two different systems of

annuities (i.e. pre-grant annuities and annuities accumulated until grant). The latter need not be

paid until the patent is granted, which may occur within four years, or take a much longer time.

There was also a need to factor in exchange rates and possible rate increases over time.

6.3. THE SOLUTION

The Portfolio Estimator - Patents has played a key role in reducing the variance between the

budgeted spend and the actual spend to within 1%. The client praised the software, first and

foremost, for meshing well with its current system, thereby enabling the client to estimate costs

with a high degree of accuracy over the lifecycle of its entire global portfolio (including both

pending patent applications and granted patents). Further, the software has also allowed the client

to make assumptions about how many applications it is going to file every year and forecast the

future costs for the yet-to-be filed applications.

Through free and frequent updates to its substantial database that is based on extensive research,

the Portfolio Estimator has also taken care of the client's varied concerns, such as fluctuation in

exchange rates and possible rate increases over time. Further, the tool's ‘time-to-grant' feature has

allowed the client to approximate when the accumulated annuity costs may be incurred.

Thus, from uncertainty over patent budgets to certainty and confidence, Chevron Phillip’s budget

estimating capabilities underwent a radical transformation since the addition of the Portfolio

Estimator - Patents to its toolbox.

14

7. CONCLUSION

“Smart” is the current business mantra. A plethora of new technologies are emerging to make

anything and everything “smart,” from electronic devices to buildings and even cities. However,

the legal industry, including in-house Intellectual Property teams, is traditionally known for its

reluctance in embracing new technologies. While this approach may have worked in the past, it

might no longer be sustainable in an era in which the demands from the C-Suite have increased

and more is expected to be done with less.

Quantify IP’s tried and tested Intellectual Property cost estimation tools provide instant and

accurate estimates of Intellectual Property costs and can help with the ‘smartening’ of the

Intellectual Property budgeting process. Decision-makers, such as Chief Legal Officers and Chief

Innovation Officers, can confidently make strategic decisions and forecast future budgets without

worrying about the possibility of a high variance between the budgeted spend and the actual spend,

which, in the past, would have forced their teams to scramble back to the drawing board to

determine cost-cutting avenues.

The Intellectual Property budgeting capabilities of many law firms and Fortune 500 companies

have undergone a significant transformation since the addition of Quantify IP’s international

Intellectual Property cost calculators to their toolbox. Don’t you want to stay ahead of the curve?

Save time and money with Quantify IP’s suite of products.

15

8. FIGURES

Jurisdictions Considered: Canada (CA), China (CN), European Patent Office (EP), Israel (IL),

India (IN), Japan (JP), South Korea (KR), Russia (RU), and the United States (US)

Priority Jurisdiction: U.S.

Type of Application Filed in the Other Jurisdictions: PCT National Phase

Exchange Rates: 1 U.S. Dollar = 1.26 Canadian Dollars, 6.65 Chinese Renminbi, 0.85 Euros,

3.52 Israeli Shekels, 65.19 Indian Rupees, 112.79 Japanese Yen, 1,141.84 Korean Won, and

57.61 Russian Rubles

Application Parameters Used (except for Scenario 2 in Figure 2):

International Searching Authority: U.S.; PCT Chapter II Entry: No; Number of Pages: 40,

including five pages of drawings; Number of Pages of Translation: 35; Number of Pages in

PCT Request Form: 6; Number of Claims: 15; Number of Independent Claims: 3; Type of

Applicant: Large Entity; Application Filed Electronically: Yes; Number of Pages of

Translation per Prosecution Action: 10

Note: The cost estimates illustrated in the figures are as per the respective Official Fee Schedules as on September

30, 2017.

16

Figure 1: Official Patent Filing Fees; there is no difference between the electronic

filing fee and the physical filing fee in Russia, China, Canada, and Israel

On the other hand, the difference between the electronic filing fee and the physical

filing fee is quite substantial in Japan, the European Patent Office, and the U.S.

Figure 2: Total Estimated Patent Costs Across the Lifecycle of a Patent; Scenario

1 is for a 40-page patent with: 15 pages of claims, 5 pages of drawings, 15 claims,

and 3 independent claims; Scenario 2 is for a 30-page patent with: 10 pages of

claims, 5 pages of drawings, 10 claims, and one independent claim

There is no difference in the costs between the two scenarios in the U.S., Canada,

and Israel.

17

Figure 3: Estimated Costs of Translating a Patent Application Filed in English into

Chinese, Russian, Korean, and Japanese; the translation costs constitute 65% to

77% of the total estimated patent filing costs

Figure 4: Estimated Costs of Translation at the Patent Prosecution Stage; the

translation costs constitute 37% to 55% of the total estimated patent prosecution costs

18

Figure 5: Estimated Costs of Translating a European Patent Granted in English

into German and French; the cumulative translation costs constitute around 65%

of the total estimated grant costs

Figure 6: Estimated Translation Costs at the Validation Stage of a Granted

European Patent in Select European Countries; the translation costs constitute

between 45% and 78% of the total validation costs.

No translation is required in France, Germany, Ireland, Liechtenstein,

Luxembourg, Monaco, Switzerland, and the United Kingdom

19

Figure 7: Estimated Costs of Maintaining/Renewing a Patent Application/Granted

Patent; annuities constitute 20% to 64% of the total estimated costs across the

lifecycle of a patent.

The costs in EP are based on 2023 being the year of grant for a National Phase

application filed in 2019.

20

For Further Information, Please Contact:

Quantify IP

1325 South Kihei Road, Suite 214

Kihei, Maui, Hawaii 96753 U.S.A.

Phone: +1-808-891-0099

Email: [email protected]

Website: https://www.quantifyip.com/