Irina Grazdane

A Customer Relationship Management

Approach for Optical Retail Business.

Helsinki Metropolia University of Applied Sciences

Master’s Degree (Master of Health Care)

Degree Programme in Health Business Management

04.11.2013

brought to you by COREView metadata, citation and similar papers at core.ac.uk

provided by Theseus

Abstract

Author

Title

Number of Pages

Date

Irina Grazdane (Irina Graždane)

A Customer Relationship Management Approach for Optical

Retail Business.

72 pages + 2 appendices

04 November 2013

Degree

Master’s Degree (Master of Health Care)

Degree Programme

Degree Programme in Health Business Management

Specialisation option

Optometry

Instructor

Thomas Rohweder, DSc (Econ)

The aim of the present study was to explore CRM notion and examine CRM approach in

terms of one particular field – the optical retail industry.

As CRM methodology is broader than just a definition, a conceptual framework was used to

assess CRM in an organization. The main objectives for research included choice of the

conceptual framework from the already existing ones, assessment of the case company

using the chosen framework, analysis of results obtained from such assessment and

development of the one main proposal for the case company.

Two European companies were selected as Case Companies – both were operating in the

field of optical retail business, having a chain of optical retail outlets and being mainly

business-to-consumer businesses. Both companies were typical examples of companies in

their field and were not direct competitors to each other. The Case Company One was

chosen to represent a large business and the Case Company Two - a mid-sized business.

Both companies were observed within a six-month period, as well as assessed using

qualitative methods. The assessment was made in order to explore their approach to CRM,

and compare it to the model chosen from relevant academic literature.

The rationale for the present study was the fact that optical retail industry in the countries of

interest was experiencing significant amount of pressure due to the worsened economy and

higher than before levels of competition. Therefore, for both companies retaining existing

customers and improving weaknesses in their CRM approach was considered a great

alternative to otherwise inevitable price war.

Five conceptual frameworks for CRM were reviewed and The QCi or The Customer

Management Model was selected. The assessment of both companies using this framework

revealed that the model is suitable for the assessment of large and middle-sized businesses

in the optical retail industry. Weaknesses of various significance were found in eight main

elements of The Customer Management Model for each company. Comparison to another

study based on The Customer Management Model showed that about a half of the

businesses had similar problems regardless of their industry.

After the review of results one major proposal to each case company was created.

Keywords

a conceptual framework for CRM, a model for CRM, optical

retail business

Contents

1 Introduction 1

1.1 Background of the problem 1

1.2 A case company 2

1.3 Research objectives 3

1.4 Research design 4

1.5 Research process and methods 5

2 Customer relationship management 7

2.1 Definition of CRM 7

2.2 Origins of CRM: relationship marketing 9

2.3 Understanding relationships 11

2.4 Building customer value 13

2.5 Customer satisfaction 14

2.6 Customer segmentation. 16

2.7 Customer relationship management 18

2.8 The role of CRM 20

2.9 Types of CRM 21

2.10 Types of business 22

3 CRM models 24

3.1 The IDIC model – Identify, Differentiate, Interact and Customize 24

3.2 The CRM Value Chain 25

3.3 A conceptual framework for CRM strategy: The Five-Process Model 27

3.4 The Gartner’s competency model: Eight Building Blocks of CRM 29

3.5 The QCi Model: The Customer Management Framework 31

3.6 CRM model for optical retail business 34

4 Customer management value chain in case companies 39

4.1 Customer management value chain 39

4.2 Analysis and Planning 40

4.2.1 Analysis and Planning in the Case Company One 41

4.2.2 Analysis and Planning in the Case Company Two 42

4.3 Proposition 42

4.3.1 Proposition of the Case Company One 43

4.3.2 Proposition of the Case Company Two 44

4.4 Information and Technology 45

4.4.1 Information and Technology: the Case Company One 45

4.4.2 Information and Technology: the Case Company Two 46

4.5 People and Organization 46

4.5.1 People and Organization in the Case Company One 46

4.5.2 People and Organization in the Case Company Two 47

4.6 Process Management 47

4.6.1 Process Management in the Case Company One 48

4.6.2 Process Management in the Case Company Two 48

4.7 Customer Management Activity 49

4.7.1 Customer Management Activity in the Case Company One 50

4.7.2 Customer Management Activity in the Case Company Two 51

4.8 Measuring the effect 51

4.8.1 Measuring the Effect: the Case Company One 52

4.8.2 Measuring the Effect: the Case Company Two 52

4.9 Customer experience 52

4.9.1 Customer Experience: the Case Company One 52

4.9.2 Customer Experience: the Case Company Two 53

5 Discussion 54

5.1 Analysis and Planning 55

5.2 Developing proposition 56

5.3 Communicating proposition 56

5.4 Information and Technology 57

5.5 People and Organization 57

5.6 Process Management 58

5.7 Customer Management Activity 58

5.8 Measuring the Effect 59

5.9 Customer Experience 59

5.10 A proposal for the Case Company One 60

5.11 A proposal for the Case Company Two 63

6 Conclusion 65

6.1 Executive summary 65

6.2 Ideas for future research 67

6.3 Evaluation 67

References 68

Appendix 1. Checklist: readiness to create CRM vision. 1

Appendix 2. Interview questions. 1

1

1 Introduction

1.1 Background of the problem

The aim of present study was to explore a CRM notion and examine a CRM approach in

terms of one particular business field – optical retail industry.

The interest for such study arose from two main factors – authors almost a decade long

experience in given business field; and discussion around CRM which had revealed the

significant zone of ambiguity in definitions of CRM, methodology of CRM; as well as practical

application of CRM in middle-size and small businesses.

Amount literature and published academic articles on topic shows that over past twenty

years there have been an explosion of interest in customer relationship management.

Despite an increasing amount of practitioner-oriented material, there remains a lack of

common agreement about what CRM is and how CRM strategy should be developed. As

Payne and Frow (2005, p.167) note, “a significant problem that many organizations deciding

to adopt CRM face stems from the great deal of confusion about what constitutes CRM”.

As a CRM methodology is broader than just definition, for a company it is not sufficient just

to explore a notion of customer relationship management. Therefore, the tool such as

conceptual framework or model was admitted as necessary to implement or assess CRM in

an organization. In terms of present research project, a purpose of such model or conceptual

framework for CRM was to describe a CRM approach across all organization structures and

to explore a role of different business processes in creation of common CRM vision.

As regards to the business field chosen, at the period of present research, no study has

been found which would be examining a conceptual framework of CRM in optical retail

business. Examining this topic, therefore, would help the case companies as well as other

companies in given business field to access their CRM approach or to implement CRM

projects.

2

1.2 A case company

Structure of business reviewed has a unique combination of main features – most

businesses in the industry operate as retail shops of consumer goods, but at the same time

they are providing primary health care services to the public. Optical retail businesses supply

consumers with prescription eyewear through outlets, which have optometrists (Doctors of

Optometry, licensed opticians – profession status varies across different countries) who are

performing vision assessment; and shop assistants or dispensing opticians who are helping

to select and fit prescription glasses or distributing contactlenses (which includes advice and

training). In recent years, there has been growth in the amount of online businesses, but

their abilities to provide primary health care services are obviously limited.

For case study research, two companies were selected (further in the text referred as the

Case Company One and the Case Company Two). Both companies are operating in the

field of optical retail business, having a chain of optical retail outlets and being mainly B2C

(business-to-consumer) businesses. Both companies were interviewed; and observed

within six months period. Case companies were assessed with an aim to explore their

approach to CRM, and compare it to the one of the models chosen from relevant academic

literature.

Companies were chosen for being typical of a large number of other similar institutions and,

hence, some level of generalization can be made. The Case Company One was chosen to

represent a sample of large businesses and the Case Company Two for the group of mid-

sized businesses.

Both case companies assessed are located in Europe, and both are related to the bigger

international chains, as well as both operate in two high income countries as stated by World

Bank (The World Bank Group, 2013). Both companies are not located in the same

geographic area, however, the countries of location belong to the European Union. The

Case Company One is a large business according to a definition of the European

Commission (company employs more than 250 people and its turnover is greater than 50

million euros) (European Commission, 2003). The Case Company Two is a middle-sized

business according to the definition of the European Commission (company has less than

250, but more than 50 employees, and turnover less than 50 million euros but more than 10

million euros) (European Commission, 2003).

3

Local optical associations’ reports in countries of interest state that optical retail industry is

experiencing a significant amount of pressure due to the worsened economy and higher

than before levels of competition (for the list of optical associations in European countries

see: The European Council of Optometry and Optics, 2013). Therefore, for each of

companies to retain existing customers and improve weaknesses in their CRM approach

would be a great alternative to otherwise inevitable price war.

1.3 Research objectives

As stated earlier, the aim of present study is to explore CRM notion and examine a CRM

approach in terms of optical retail business. The value of a model for CRM methodology is

discussed in Payne and Frow (2005, p.167), and authors admit that “a conceptual framework

for CRM helps broaden the understanding of CRM”; as well as its “role in enhancing

customer and shareholder value”.

It states following set of goals for current research – to explore a notion of CRM, conceptual

frameworks or models of CRM already available, all with aim to choose one best suitable

conceptual framework for assessment of business in optical retail industry. Above

mentioned steps will be followed by study in case companies with aim to explore their

approach to CRM and compare data to a chosen model.

In conclusion, a present project has four main objectives of research. Those are as follows:

1) To choose a (theoretical) conceptual framework (a model) for CRM suitable for

assessment of a company operating in optical retail industry;

2) To assess a CRM approach in both case companies using a model chosen;

3) To analyse and discuss the results of an assessment of CRM approach in both case

companies and identify possible weaknesses that may be found;

4) To develop one major proposal to each one case company which would help to

overcome weaknesses in CRM approach found during assessment.

Some expectations for results of current research arose from preliminary research on

literature and author’s own experience. As Buttle (2009, p.5) note, many businesses of any

size claim that they are “on mission to satisfy customer needs profitably” and are customer-

4

oriented; but few actually are. Based on that, it is expected to find a higher company’s self-

assessment results for CRM vision than it actually is, as well as weaknesses in CRM

approach.

As regards to CRM technology, it is expected to find that small and middle-sized businesses

won’t have CRM systems in use; instead they most likely will have sales force automation

systems.

1.4 Research design

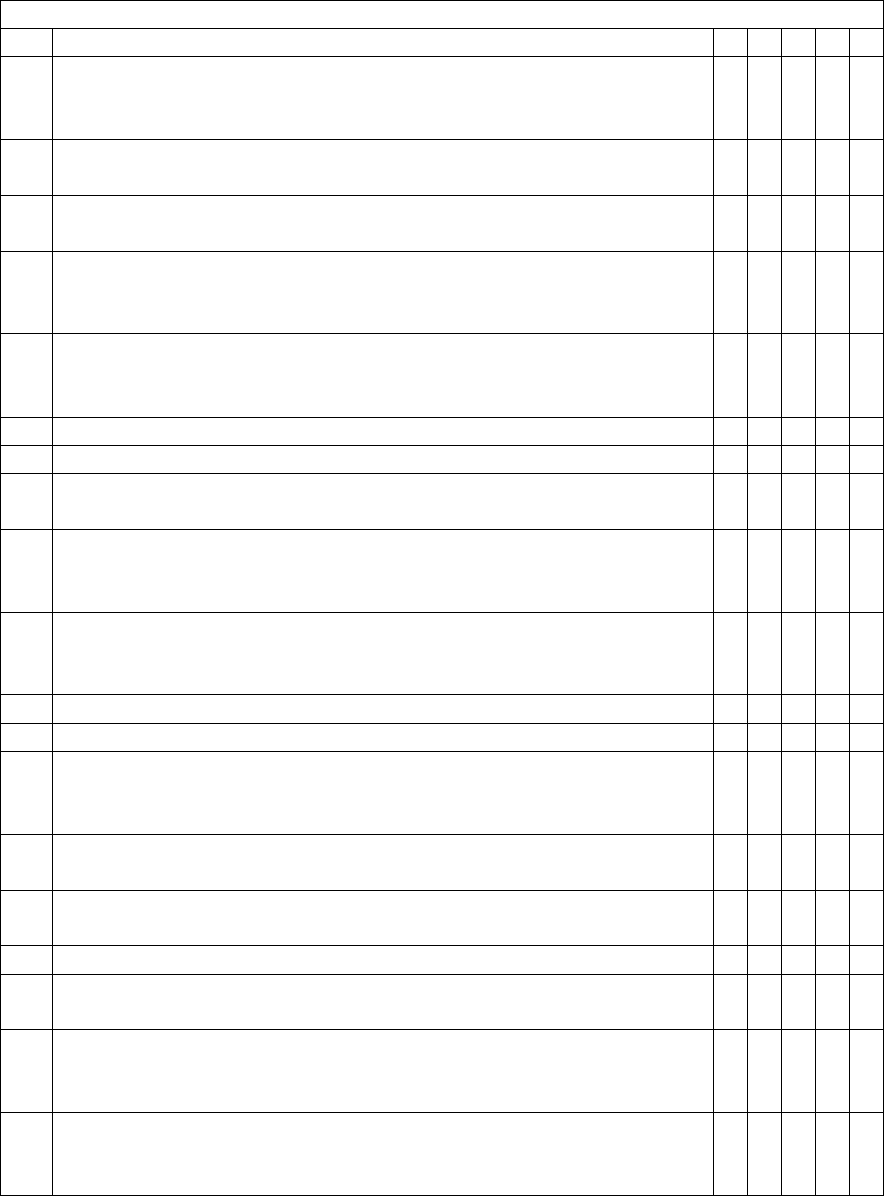

Based on research objectives, research design had five major stages which are shown in

Figure 1.

Figure 1. Research design: five major stages.

A comparison of research results in case companies to a chosen CRM model. Data obtained

from each case company was analysed and compared to the best practices. Possible gaps

and solutions discussed.

Interviews with persons responsible for and involved in CRM strategy in case companies.

The choice of a model for optical retail industry using ongoing discussions among researches

and practitioners as well as researcher’s own experience within this field.

A review of different strategic frameworks or models of CRM.

A review of current CRM knowledge in academic literature.

5

At the moment of creation of research design the biggest challenge for the whole research

was getting access to the case companies.

1.5 Research process and methods

Before conducting research within case companies, literature research with aim to explore

the actual notion of CRM and models of CRM was necessary. A creation of a conceptual

framework usually is based on the best practices and researches in numerous amount of

companies. Therefore, the descriptions of the best practices listed together with strategic

frameworks were admitted appropriate source for development of questions for a case

company assessment.

As the aim of the study was to evaluate a CRM approach, the interpretative epistemology

supported by data collected through interviews was admitted as the most appropriate for

this purpose. The questionnaire or other quantitative methods were excluded as a main

research tool as those serve better in providing statistical results over a large amount of

data. However, although interviews were chosen as a primary data collection method, there

was a necessity in observational techniques where they seemed appropriate. Therefore,

observation of the company’s work, information on the internet, activity in social media and

study of employee-oriented educational material if available were as well assisting in the

collection of data and creation of analysis. Questions for interviews were created as open

questions with no possible answer just yes or no. In such way a researcher would ensure

that interviews are providing more insight in approaches, and reasons for such approaches.

It was done also in order to avoid too positive results which may occur due self-assessment.

For example, when interviewee was asked about a company’s strategy s/he was asked to

define it; a researcher recorded statement, and after analysed and compared it with the best

practice, as well as made conclusion whether it is customer-centric. The set of questions

was sent to a company’s human resources department with an explanation on main issues

of research, data collection methods and information about study program. The human

resources department was asked for help in the choice of a purposive sample.

To help respondents to feel at ease, and enable them some degree of control over a data

collection process, interview questions were sent to interviewee before the actual interview

6

happened; as well as no tape record of an interview was done. Researcher was using own

laptop during an interview and an interview transcript was made simultaneously. If

respondent expressed interest, the interview transcript was sent or showed right after an

interview happened. Due confidentiality issues no financial, supplier or other potentially

sensitive data were provided, as well as all names and positions of respondents were

disclosed in the research report. The fact that interviewee was familiar with interview

questions ensured avoiding a waste of scarce time resources; as well as ensured that the

interview is conducted in a very intense manner. Due the same confidentiality concerns no

transcripts or other data from the interviews will be published or otherwise distributed.

To evaluate a company’s position in relation to its rivals the activity in social media for both

companies and their direct competitors was followed for over a half of year long time. To

measure customer experience and efficiency of a value proposition, one “mystery shopping”

case for the Case Company One was evaluated; and observation of everyday work of the

Case Company Two for two days in different units was used. All information was assisting

in assessment and served its purpose in helping to broaden information obtained from the

interviews.

A brief review on CRM technologies made an impression that small or medium size

enterprises won’t be amongst early adopters of CRM, and many even nowadays wouldn’t

have any CRM solution or analytic tools mainly because of the size of business. It was tested

in current research, as one of the companies assessed is a middle-sized business according

to a definition of the European Commission (European Commission, 2003).

Results of an assessment for both companies presented in this thesis are results of the

analysis of the interviews. It was made by comparing answers with a description of the best

practice for the case. Besides techniques mentioned before or during an interview each

interviewee was asked to perform a self-assessment of a company’s readiness to create a

CRM vision using a self-assessment questionnaire created by Brown and Gulycz (2002).

This questionnaire allows to assess overall level of readiness towards a CRM vision for the

company. Authors suggest to use it as a guide for reading their book, and divide all

companies to three groups where companies (1) aren’t ready for CRM vision and need more

improvement, (2) partially ready and need advice on major issues and (3) are completely

ready and only need advice on advanced techniques. (Brown & Gulycz, 2002) A

7

questionnaire was used to evaluate where a company sees itself. A research was using it

also as a source assisting in the main analysis.

2 Customer relationship management

First, before starting to review which models of CRM are the most suitable for organizing

business practices in optical retail industry, it is necessary to clearly define what CRM

means. Research on the topic showed a certain level of ambiguity for the meaning of this

three-letter acronym (CRM) in relevant literature. Therefore, the following section

represents review of different publications regarding the topic of CRM.

Definitions aside, to describe a CRM, there is a strong need in reviewing relationship

marketing, relationship aspects and customer value creation in terms of CRM frameworks,

as those all are important aspects in building customer-centric strategy.

2.1 Definition of CRM

Literature on the topic quite clearly indicates that expression customer relationship

management, or CRM, or even closely related to the topic term ‘relationship marketing’ have

been in use only since early 1990s. (Gamble, et al., 1999; Kotler, et al., 2009; Baron, et al.,

2010). According to Gamble, et al. (1999), a customer relationship management is relatively

immature business or organizational practice, and even consensus has not yet emerged

about what counts as CRM.

The meaning of the CRM acronym varies as well. For example, it may be used both in

relation to customer relationship management, and in relation to customer relationship

marketing. (Gamble, et al., 1999; Payne, 2009). Furthermore, in more contemporary

sources, authors suggest that customer relationship management should be replaced by

term ‘customer management’ or CM, but a two-letter acronym is RM are widely used for

relationship management (Baron, et al., 2010; Woodcock, et al., 2003; The Customer

Framework Ltd, 2011-2013). Quite often CRM is used to refer a specific technology-based

solution, such as data warehouse, or even one specific application such as campaign

8

management or sales force automation. (Payne, 2009) From the following sample of

definitions shown in the Table 1. it can be clearly seen that meaning of CRM varies greatly.

Table 1. Definitions and descriptions of CRM.

Years

Definitions and descriptions of CRM

1995 -

1999

Data-driven marketing (Kutner & Cripps, 1997 cited in Payne, 2009, p.19).

(CRM) Seeks to provide a strategic bridge between information technology and

marketing strategies aimed at building long-term relationships and profitability. This

requires “information-intensive” strategies. (Glazer, 1997 cited in Payne, 2009, p.19)

CRM can be viewed as an application of one-to-one marketing and relationship

marketing, responding to an individual customer based on what the customer tells you

and what else you know about that customer (Peppers, et al., 1999, cited in Payne, 2009,

p.19).

A management approach that enables organizations to identify, attract and increase

retention of profitable customers by managing relationships with them (Hobby, 1999,

cited in Payne, 2009, p.19).

2000-

2004

CRM or customer relationship management is the infrastructure that enables the

delineation of an increase in customer value, and the correct means by which to motivate

valuable customers to remain loyal – indeed, to buy again (Dyché, 2001, p. 4).

A comprehensive strategy and process of acquiring, retaining and partnering with

selective customers to create superior value for the company and the customer

(Parvatiyar & Sheth, 2001, p. 6).

CRM is a business strategy combined with technology to effectively manage the

complete customer life-cycle (Smith, 2001, cited in Payne, 2009, p.19).

2005-

2009

CRM is a strategic approach that is concerned with creating improved shareholder value

through the development of appropriate relationships with key customers and customer

segments. CRM unites the potential of relationship marketing strategies and IT to create

profitable, long-term relationships with customers and other key stakeholders. CRM

provides enhanced opportunities to use data and information to both understand

customers and co-create value with them. This requires a cross-functional integration of

processes, people, operations, and marketing capabilities that is enabled through

information, technology, and applications. (Payne & Frow, 2005, p. 168)

CRM is the core business strategy that integrates internal processes and functions, and

external networks, to create and deliver value to targeted customers at a profit. It is

grounded on high quality customer-related data and enabled by information technology.

(Buttle, 2009, p. 15)

(CRM) is a business strategy the outcomes of which optimize profitability, revenue and

customer satisfaction by organizing around customer segments, fostering customer-

satisfying behaviours and implementing customer-centric processes. CRM technologies

should enable greater customer insight, increased customer access, more effective

customer interactions, and integration throughout all customer channels and back-office

enterprise functions (Gartner, Inc., 2013).

From the chronological order of various definitions presented in the Table 1. can be seen

that earlier sources emphasize information technology and marketing automation as main

determinants for CRM. More contemporary literature mentions CRM as first and foremost a

9

business strategy where appropriate business processes and CRM technologies enable

“greater customer insight, increased customer access, more effective customer interactions,

and integration throughout all customer channels and back-office enterprise functions”

(Buttle, 2009; Gartner, Inc., 2013). In terms of the present research term CRM will be used

to describe a customer-oriented business strategy in relation to business and technology

management processes used to implement it; as a business philosophy fostering customer-

satisfying behaviours across all organization levels; and as an approach used for

development of relationships with profitable or strategically important customer segments.

As mentioned previously, CRM often used in context with relationship marketing. Payne

(2009) suggests that CRM practices originate from relationship marketing principles, so a

brief review of the development of relationship marketing is helpful to an understanding of

evolution of CRM.

2.2 Origins of CRM: relationship marketing

Before reviewing relationship marketing and emergence of CRM, it is important to clearly

define what a relationship marketing and a database marketing mean. As we can see from

the Table 1. (in the previous sub-section), they often come together in definitions of CRM,

so they might be regarded as mutually replaceable synonyms. However, both are not exactly

the same.

Kotler et al. (2009), describe relationship marketing as a business process of “building

mutually satisfying long-term relationships with key parties, in order to earn and retain their

business”. According to Bruhn (2003, p.11) “relationship marketing covers all actions for the

analysis, planning, realization, and control of measures that initiate, stabilize, intensify, and

reactivate business relationships with the corporation’s stakeholders – mainly customers –

and to the creation of mutual value”.

As regards to database marketing, it is the process of building, maintaining and using

customer databases and other databases (products, suppliers, resellers) to contact, transact

and build customer relationships. Such databases can assist marketing managers in daily

operations, budget planning, market segmentation, targeting, offer development, customer

10

communication; and resource allocation. The marketing database can be used also to assist

in strategic decision processes. (Tao & Yeh, 2003)

According to Payne (2009), the emergence of CRM as a management approach is a

consequence of a number of important trends. These are described as follows:

- The shift in business focus from transactional marketing to relationship marketing

- The realization that customers are a business asset and not simply a commercial

audience.

- The transition in structuring organizations, on a strategic basis, from functions to

processes

- The recognition of the benefits of using information proactively rather than solely

reactively

- The greater utilization of technology in managing and maximizing the value of

information

- The acceptance of the need for trade-off between delivering and extracting a value for

a customer

- The development of one-to-one marketing approaches (Payne, 2009, p. 11)

Traditional marketing models are based on the exchange perspective, where a value for

customers has been pre-produced by firm. (Sheth & Parvatiyar, 1995) It “involves greater

financial outlay and risk. Focusing on single sales involves winning the customer over at

every sales encounter, a less efficient and effective use of investment” (Payne, 2009, p. 11).

As return on marketing costs cannot be calculated, it is difficult to evaluate or improve

marketing productivity. (Grönroos, 2007)

The situation is quite different according to the relationship perspective. Value for a customer

is created by the customer himself. It is a process which occurs during a relationship, partly

in interactions between the customer and the service provider. (Sheth & Parvatiyar, 1995)

As regards to return on marketing costs, new business logic offers usage of resources in an

“intelligent way”. Managing customers is a process to which all organization contributes.

(Grönroos, 2007)

A key aspect of relationship marketing is building customer value in order to retain

customers, which means building on the already existing investment in product development

11

and customer acquisition. In such way company generates potentially higher revenue at a

lower cost. (Payne, 2009)

Besides financial benefits, relationship marketing also produces significant intangible

assets. The emphasis on a customer service encourages customer involvement. It allows

to learn more about customers’ needs and use this knowledge into future product or service

development and delivery. Businesses must know their customers (and competitors) in

order to increase customer satisfaction and reduce customer attrition. This knowledge

should be used proactively, which means that company doesn’t wait for complaints to be

registered, but actively seeks to uncover and remedy customer dissatisfaction. It is important

to recognize that customers often never lodge a complaint; they simply leave or take their

businesses elsewhere. (Payne, 2009)

Modern technology can be used by the company to listen and learn from its customers; as

well as to collect and manage a complete set of information that enables value-adding

interactions with customers, often across different channels. (Payne, 2009)

2.3 Understanding relationships

A notion of relationship is quite often discussed in relation to CRM, and in all sources it

stands for R letter in acronym. In terms of the present research, therefore, the topic of

relationship in the context of business and management practices should be discussed.

According to Buttle (2009, p.27), “a relationship is composed of a series of interactive

episodes between dyadic parties over time. The parties within the dyad may have very

different ideas about their relationship status”. A relationship is a “social construct” which

exists in a case if “people believe in its existence and act accordingly”. “Relationships can

be unilateral or reciprocal; either one or both of the parties may believe they are in a

relationship”. (Buttle, 2009, p.28) Usually, it is a customer’s decision to determine whether

or not a relationship has developed, and it means a mutual way of thinking between

customer and supplier or service provider. It is an ongoing process with win-win situation for

both parties. (Grönroos, 2007; Håkansson & Snehota, 1995) Grönroos (2007) suggests that

if a relationship has been established, customers should be treated as customers,

regardless of whether at any given point of time they are making purchase or not.

12

Relationships evolve over time, they can vary considerably, both in number and variety of

episodes. According to Dwyer et al. (1987), there are five general phases through which

customer-supplier relationships evolve: awareness, exploration, expansion, commitment

and dissolution. An important aspect here is that many relationships are terminated before

commitment stage. (Buttle, 2009) Studies indicate that core attributes of quality relationship

are trust and commitment. Other attributes include relationship satisfaction, mutual goals

and cooperative norms. (Buttle, 2009)

Trust in another party is described as one party’s expectation that the other party will behave

in a certain predictable way in a given situation. If the other party does not behave in the

expected way, the trusting party will experience more negative outcomes than they

otherwise would. (Swartz & Iacobucci, 2000) Trust develops when both parties share

experiences, interpret and assess each other's motives. The development of trust is a long-

term investment into a relationship and it is a factor that ensures its longevity. (Singh &

Sirdeshmukh, 2000, cited in Buttle, 2009, p.29)

Commitment is shown by “an exchange partner believing that ongoing relationship with

another is so important as to warrant maximum effort to maintain it; that is the committed

party believes the relationship is worth working on to ensure that it endures indefinitely”

(Morgan & Hunt, 1994, p. 23). Trust, shared values, and the belief that partners will be

difficult to replace are elements that lead to commitment. It motivates both parties to

cooperate in order to preserve a relationship. (Buttle, 2009, p. 30) Deeply held commitment

or loyalty is a tendency to choose a preferred product or service in the future despite

situational influences which may have the potential to cause switching behaviour (Hamel,

1996).

However, the research supporting conclusion that trust and commitment is more for

relational customers is rather limited. Hence, there is no clear relation between trust,

commitment and the development of commercial relationships. (Grönroos, 2007)

Evidence suggests that one of the main points of improving relationship tenure and increase

retention is concentrating on building customer value and ensuring that customer

satisfaction remains on the appropriate level and is measured continuously. It is self-evident,

that the same needed to attract customers. Therefore, it is important to review what exactly

two abovementioned variables – a customer value and a customer satisfaction mean in

terms of customer-oriented business strategy.

13

2.4 Building customer value

An objective of CRM is a balance between the value delivered to customers and the value

received in return. The value proposition needs to be tailored for different customer

segments. (Payne, 2009)

According to Schieffer (2005) creating loyal customers is at the heart of every business. As

Peppers and Rogers wisely note,

The only value your company will ever create is the value that comes from the

customers - the ones you have now and the ones you will have in the future.

Businesses succeed by getting, keeping, and growing customers. Customers are the

only reason you build factories, hire employees, schedule meeting, lay-fibre optic lines,

or engage in any business activity. Without customers, you don't have a business

(Peppers & Rogers, 2005, p. 25).

Several sources repeat this views and describe effective marketing as being about the

identification, design and delivery of customer-perceived value. (Dubois, et al., 2007; Payne

& Holt, 2001; Kotler, et al., 2009) Many companies recognize the importance of satisfying

their customers in order to develop brand reputations that can deliver a sustainable

competitive advantage. Such communication is particularly important, where the vast

majority of staff are either on the shop floor dealing with customers, or behind the scenes in

areas such as the supply/value chain where they can feel divorced from central operations.

(Kotler, et al., 2009)

To reveal the company's strengths and weaknesses in relation to its competitors, a

customer-perceived value analysis can be conducted. Customer-perceived value CPV is

“the difference between the prospective customer's evaluation of all the benefits and all the

costs of an offering and the perceived alternatives”. (Kotler, et al., 2009, p. 381)

Customer-perceived value analysis consists of five major steps:

1. Identification of the major attributes and benefits that customer value.

2. Evaluation of the quantitative importance of different attributes and benefits.

3. Evaluation of the company's and its competitors' performance on the different

customer values against their rated importance.

14

4. Examination of how customers in a specific segment evaluate a company's

performance against a specific major competitor on an individual attribute or benefit

basis.

5. Monitoring of customer values over time. (Kotler, et al., 2009, pp. 385-86)

With the rise of digital technologies such as the Internet customers become more and more

informed; they expect companies to connect with them and to listen to them. Customers are

gradually becoming more demanding and instantly looking for better value (Urban & Hauser,

2004; Grönroos, 2007). In relation to that, Pine & Gilmore (1999) speak about an emergence

of experience economy. In the experience economy customers are looking for more than

ordinary goods or services and are prepared to pay substantially more for experience

services. Similar ideas are expressed also by Grönroos (2007) - customers do not look for

goods and services “per se”, they look for a solution that serves their own value-generating

processes. Sometimes this service requirement can be offset by a low price, a brand image

or a technologically more advanced solution. Often the act of rapidly recovering from a

mistake, not the brand attribute of flawless service, is what wins customers loyalty and

returns business (Kotler, et al., 2009).

The value proposition of a company is more than the core positioning of the offering. It

consists of the whole cluster of product and service attributes (benefits) the company

promises to deliver. The company's ability to manage its value delivery system is crucial in

keeping this promise. (Lanning, 1998) Important to remember that the value delivery system

includes all the experiences the customer will have on the way to obtaining and using the

offering. A good value delivery system is a set of core business processes that help to deliver

promised value and ensure that the customer has a pleasurable purchasing experience.

(Kotler, et al., 2009)

2.5 Customer satisfaction

Evidence suggests that despite the amount of research on the topic customer satisfaction

has been defined many ways as well. Buttle proposes to define customer satisfaction as

“the customer's fulfilment response to a customer experience, or some part thereof” (Buttle,

2009, p. 44). For customer-oriented companies, a customer satisfaction is both goal and

15

marketing tool. Companies even include customer satisfaction ratings in their advertising

once high ratings occur. (Kotler, et al., 2009)

Kotler, et al. (2009) suggest that companies should measure customer satisfaction regularly

as it is an important key to customer retention. Usually satisfied customers are customers

that stay loyal longer and buy more as the company introduces new products and upgrades

existing ones. Such customers are less price sensitive and tend to promote the company by

word of mouth, as well as pay less attention to competing brands. The cost to serve for loyal

customers is lower because transactions can become routine. Greater customer satisfaction

has also been linked to higher returns and a lower risk in the stock market. (Kotler, et al.,

2009)

There are several main methods to measure customer satisfaction - periodic surveys, a

customer loss rate monitoring and a “mystery shopping”. Periodic surveys are methods that

measure customer satisfaction directly. Besides, the company can also ask additional

questions to measure repurchase’s intention and the respondent's likelihood or willingness

to recommend the company and brand to others. As regards to customer loss rate

monitoring – a company can do more than that and contact customers who have stopped

buying or who have switched to another supplier to find out why. Quite often companies hire

“mystery shoppers” to pose potential buyers and report on strong and weak points

experienced in service or products both of the company researched and of its competitors.

In a situation where they are unknown, managers themselves can enter either company or

competitor sales situations. In such way they can experience at first hand the treatment

they receive, or they can phone their own company with questions and complaints to see

how employees handle the calls. (Kotler, et al., 2009)

According to the expectations-disconfirmation model of customer satisfaction, a buyer’s

satisfaction after purchase depends on the offer's performance in relation to the expectations

of its performance, and whether any deviations between the two are found. If the

performance matches the expectations, the customer is satisfied. Dissatisfaction occurs if

the performance falls short of expectations. High levels of satisfaction occur when an offer’s

performance exceeds expectations. (Grönroos, 2007; Kotler, et al., 2009; Buttle, 2009) As

Grönroos (2007) note, for customer satisfaction it is always better to underpromise and

overdeliver.

16

Expectations are formed by past buying experience; a friend’s or associates’ advice; and a

marketers' or competitors’ information and promises. As discussed, if marketers raise

expectations to high, the customer is likely to be disappointed. However, “underpromising”

should be used with caution. If the company sets expectations too low, it will not attract

enough buyers. As regards to the quality of service or product received, it is also perceived

trough comparison between expectations and experiences. (Grönroos, 2007; Boulding, et

al., 1999; Kotler, et al., 2009)

Although a customer-centred company seeks to create customer satisfaction, it should not

be its ultimate goal. To achieve success, a company must take into consideration its

resources and operate on the philosophy that it is trying to deliver both a high level of

customer satisfaction and acceptable levels of satisfaction to the other stakeholders.

(Johnson & Gustafsson, 2000)

In the case of mistakes, the best thing the company can do is to make it easy for a customer

to complain. Studies of customer dissatisfaction show that customers are dissatisfied with

their purchases about 25 percent of the time, but that only 5 percent complain. The other 95

percent either feel complaining is not worth the effort, or they do not know how or whom to

complain, or they just stop buying. A customer who have complained to an organization and

had their complaints satisfactory resolved tell an average 5 people about the good treatment

they received. The average dissatisfied customer, however, complains to 11 people. (Kotler,

et al., 2009, pp. 392-93)

2.6 Customer segmentation.

For the effectiveness of the business it is important to start with a good foundation and build

an ability to recognize those customers that will have a greatest impact on successful

performance (Brown & Gulycz, 2002). Importance of customer segmentation should not be

underestimated as the mass market has disappeared, and a better targeting of offers saves

money, improves profitability of the business and serves as a way to explore untapped

business opportunities (Wong, 2011).

17

There are many variations on the theme of segmentation. Payne (2009) lists segmentation

by service or by value sought; geographic, demographic, socioeconomic, psychographic,

benefit, usage, loyalty; and occasion segmentation.

Wong (2011) suggests following eight key characteristics of market segment:

1. Each segment should be homogeneous within itself

2. Different segments should be heterogeneous between themselves

3. Each segment should demonstrate measurable difference

4. Segmentation should be justifiable financially

5. Each segment should be durable

6. Each segment should be large enough to be economically sustainable

7. Each segment should not only be identifiable but also actionable through segment

profiling

8. Each segment should be accessible through regular media and distribution

channels. (Wong, 2011)

Traditional methods of segmentation start with breaking down a customer base into

recognizable and manageable groups. For example, a segmentation can be done using a

cluster analysis (demographic, psychographic and behavioural characteristics). One of

popular variations of segmentation practices is based on the customer value. It is a concept,

in which business decisions are not based on the revenue amount, but on the total value of

a customer for an organization. A company determines its customers’ value by looking on

both quantitative and qualitative data, evaluating such issues as a potential growth, a

sensitivity to the price and a possibility of selling value-added enhanced services or

products. (Brown & Gulycz, 2002)

By profiling customers and dividing them into segments a company gets a tool for creation

of more targeted offers. Additionally, it allows to measure actual behaviour of those groups

over time against expected results. However, dividing customers into groups and gathering

information sporadically will not drive an enhanced ability to create lasting CRM.

Segmentation should be done at least once a year or whenever significant changes are

made in the company’s business model. (Brown & Gulycz, 2002)

18

Besides abovementioned types and aspects of segmentation, it is important to consider the

relationship mode with a firm in which customer is at the moment. According to Grönroos

(1997), in a given marketing situation the customer is either in a relational or in a

transactional mode. Consumers or users in a relational mode can be in an active or a

passive relational mode.

Transactional customers are customers that look for solutions to their needs at an

acceptable price. They do not appreciate contacts from the supplier or service provider in

between purchases. Active relational customers are customers looking for opportunities to

interact with the supplier or service provider in order to get additional value. Such customers

get disappointed if a contact with supplier or service provider is not possible. Passive

relational customers need an opportunity to contact service provider or supplier if they

wanted to, but they seldom respond to invitations to interact. (Grönroos, 2007)

Although it might seem that for the customer it is better to stay in a transactional mode and

look for the most acceptable offers at moment, there are several benefits for the customer

in relationship with service provider. According to Gwinner et al. (1998) those are confidence

(e.g., reduced anxiety and faith in service provider), social benefits (such as personal

recognition by employees) and special treatment (it includes extra services and special

prices, as well as higher priority than other customers). However, the ultimate benefits for

customers of being involved in a relationship should be financial such as increased wealth

and/or revenue-generating capability or lower costs of being a customer. (Grönroos, 2007)

2.7 Customer relationship management

CRM is relatively recently emerged business concept, but, as Dyché notes “talk to a

marketing executive for a large bank or credit card company, and she or he might claim to

have been doing CRM long before the tem was invented” (Dyché, 2001, p. 10) It means,

that principles and approaches of CRM are not completely unfamiliar, and were used by

organizations long before the whole concept has emerged. (Buttle, 2009; Payne, 2009)

Despite this, as can be seen from a wide variety of definitions, there are still numerous

misunderstandings about what CRM is.

19

Buttle (2009) suggests that there are at least five major misunderstandings about CRM.

Those are listed as follows:

1. CRM is database marketing. As discussed previously, database marketing is a tool that

can assist marketing managers in different tasks. CRM has much wider scope.

2. CRM is marketing process. CRM is a business strategy, and the deployment of a CRM

software means that customer-related data is shared across all organization

departments. Customer-related data can be used to produce customized products or

services, to help recruit and train customer-facing staff; and to develop new products.

Such misunderstanding arose from the fact that many CRM software applications are

used for marketing activities such as market segmentation, customer acquisition,

customer retention; and customer development.

3. CRM is an IT issue. A goal of CRM is the development of relationships with profitable

customers, as well as retention of those that worth retaining. This is not necessarily

related to IT investment; those may be behavioural changes in store employees, an

education of call centre staff, and a focus on empathy and reliability from salespeople. IT

is used to enable development and implementation of those processes. The importance

of people and processes should not be underestimated, as a CRM software cannot

compensate for bad processes or unskilled people. Successful CRM implementations

involve people designing and implementing processes that deliver value to both a

customer and a company.

4. CRM is about loyalty schemes. Loyalty schemes provide a company with information

about customers and may serve as an exit barrier for a customer. But not all CRM

implementations are linked to loyalty schemes.

5. CRM can be implemented by any company. A strategic CRM indeed can be

implemented by any company. Every organization can be driven by desire to be

customer-driven. Any company also can implement an operational CRM by using sales

force automation, lead management and contact management processes. However,

analytical CRM is based on customer-related data. If data is missing or is of poor quality,

then analytical CRM cannot be implemented. (Buttle, 2009, pp.12-14)

CRM, also more recently called "customer management", is a business approach that seeks

to create, develop, and enhance relationships with carefully targeted customers in order to

improve customer value and corporate profitability and thereby maximize shareholder value.

(Woodcock, et al., 2003) CRM is aimed at increasing the acquisition and retention of

20

profitable customers by, respectively, initiating and improving relationships with them.

(Payne, 2009)

CRM is not simply a software application or system for tracking client data and activities. It

is a strategic business tool that can be used effectively for business growth. CRM should

serve as the single point of contact to help understand customer’s needs, and apply

knowledge from previous interactions with customers to design better products, services,

and business processes for your target customer segments. (Wong, 2011).

2.8 The role of CRM

Many discussions about the role of CRM in businesses start with often-quoted factoid that it

costs a company six times more to sell a product to a new customer than it does to sell to

an existing one. Although six times is acknowledged as the prevalent figure, reports on new-

customer acquisition costs vary, from low as three times to as high as thirteen times. (Dyché,

2001) However, two main aspects should be taken into consideration when we discuss a

role of CRM. First, it may not always be a profitable strategy for a firm to be relationship-

oriented. And second, a customer relationship strategy takes time to provide a value, it is

not seen in first quarter report. It is definitely not a short-time fast profit strategy. (Grönroos,

2007) If the firm has shareholders who reacting on quarterly results, it is difficult to establish

the long-term relationships with customers. The same applies also to partnerships with

suppliers, distributors and other network partners that may be needed. It forces

management to focus on short-term value-creating decisions. (Reichheld, 1996)

CRM needs an appropriate CRM vision, strategy, action plan and implementation. To ensure

success of CRM, a mechanism to measure, monitor, and manage its performance is

required. (Brown & Gulycz, 2002)

From previous section can be clearly seen that CRM is about understanding customer

needs, attracting new customers and retaining them, and all that became more easily

achievable with relative recent advancements of technology. But what is more important,

CRM helps companies to understand, which customers they are willing to keep. Costs of

serving certain customers may be higher than the profit they bring, so it is wise for the

company to let them to churn. And last but not least – a CRM helps businesses to save

21

money using more targeted marketing campaigns and not overspending on customer

segments which may not bring any profit at the end. Therefore, the main reason for building

relationships with customers is economic. (Buttle, 2009)

The customer base should be created with the goal to retain existing customers and recruit

new customers that have future profit potential or otherwise important for strategic purposes.

Customers are not equally important, some may not be worth recruiting or retaining at all.

Those who have a high cost-to-serve, debtors, late payers or promiscuous (in the sense that

they switch frequently between suppliers) are not worth investment. (Buttle, 2009)

Improving valuable customer retention rates reduces company's marketing costs and gives

better customer insight. The cost-to-serve of existing customers also tends fall over time.

Besides better understanding of customer requirements and expectations by a company,

customers themselves also come to understand what supplier or service provider can do for

them. (Buttle, 2009).

2.9 Types of CRM

According to Buttle (2009), there are four major types of CRM: strategic, operational,

analytical and collaborative CRM. Payne (2009) classifies CRM into three types: operational,

analytical and collaborative CRM; as well as mentions strategic CRM, e-CRM and partner

relationship marketing. Four types of CRM – strategic, operational, analytical and

collaborative are presented in Table 2.

All three types – operational, analytical and collaborative are often referred as three

components of CRM, needed to create a successful CRM. (Buttle, 2009; Payne, 2009)

Similar idea is expressed in Grönroos (2007), where relationship strategy has three main

tactical elements:

1. Direct contacts with customers and other business partners

2. A database covering necessary information about customers and others

3. A customer-centric service system. Employees, technology, customers and time are

central resources to development of a successful service system. It creates extra cost if

central resources are badly managed. (Grönroos, 2007)

22

Table 2. Four types of CRM.

Strategic CRM

Strategic CRM is a customer-centric business culture and strategy that aims

at winning and keeping profitable customers. (Buttle, 2009, p. 4) It involves

the development of an approach to CRM that starts with the business

strategy of the enterprise and is concerned with development of customer

relationships that result in long-term shareholder value creation. (Payne,

2009, p. 24)

Operational CRM

Operational CRM focuses on the automation of customer-facing and

customer-supporting processes such as selling, marketing and customer

service. Major CRM software applications within operational CRM are

enabling marketing automation, sales-force automation and customer

service automation. (Buttle, 2009)

In the mid-1990’s term CRM is often used to describe technology-based

customer solutions, such as sales force automation (SFA). (Dyché, 2001;

Buttle, 2009; Payne & Frow, 2005) According to Buttle, SFA was the original

form of operational CRM. (Buttle, 2009)

Analytical CRM

Analytical CRM focuses on the intelligent mining of customer related data

for strategic and tactical purposes. Analytical CRM is concerned with

capturing, storing, extracting, integrating, processing, interpreting,

distributing, using and reporting customer-related data to enhance both

customer and company value. (Buttle, 2009)

Collaborative

CRM

Collaborative CRM involves the use of collaborative services and

infrastructure to make interaction between a company and its multiple

channels possible. This enables interaction between customers, the

enterprise and its employees. (Payne, 2009, p. 23) Collaborative CRM is the

term used to describe the strategic and tactical alignment of normally

separate enterprises in the supply chain for the more profitable identification,

attraction, retention, and development of customers. (Kracklauer, et al.,

2004)

2.10 Types of business

Customer-centricity competes with other business logics. Kotler (2000) identifies three other

major business orientations: product, production, and selling.

Product-oriented businesses believe that customers choose products with the best quality,

performance, design or features. In these firms it is common for the customer’s voice to be

missing when important marketing, selling or service decisions are made. Little or no

customer research conducted and management makes assumptions about what customers

want. These are often very innovative businesses with overspecified and overengineered

23

products for the requirements of the market. They usually are oriented price-insensitive

“innovators”, which is 2.5% of the market. (Kotler, 2000)

Production-oriented businesses base their strategy on low-price products. Consequently,

these businesses do all efforts to keep operating costs low and to develop low-cost routes

on the market. (Kotler, 2000)

Sales-oriented businesses invest in advertising, selling, public relations and sales

promotion. Their strategy is to persuade customers to buy. (Kotler, 2000)

Customer- or market-oriented companies are putting the customer first. Their strategy based

on collection, dissemination and use of customer or competitive information in order to

develop better value propositions for their customers. A customer-centric firm is a learning

and adaptive enterprise. It constantly adapts to customer’s requirements and competitive

conditions. Evidence suggests that customer-centricity correlates strongly with overall

business performance. (Deshpande, 1999)

As Buttle (2009, p.5) states, “many managers would argue that customer-centricity must be

right for all companies. However, at different stages of market or economic development,

other orientations may have stronger appeal”. It is not always profitable for the company to

be customer-centric. (Buttle, 2009; Grönroos, 2007)

As regards to the industry I am reviewing in this Thesis, it is first and foremost service

business. According to Grönroos,

A service is a process consisting of a series of more or less intangible activities that

normally, but not necessarily always, take place in interactions between the customer

and service employees and/or physical resources or goods and/or systems of the

service provider, which are provided as solutions to customer problems. (Grönroos,

2007)

Important generic characteristic of services is that services are produced and consumed

simultaneously and the customer is a co-producer of the service, at least to some extent. As

services don’t exist before they are consumed, the quality of particular product or service is

whatever the customer perceives it to be (Grönroos, 2007).

24

3 CRM models

As can be seen from the previous chapter there is a wide variety of different aspects of CRM.

Creating a model or a conceptual framework is a good way to apply rich theoretical

information to practice. A company can use such model in evaluation of its processes and

organization structures, step by step, in order to see where present processes create or

destroy value for customers and, therefore for stakeholders of the company.

Following subsections are representing descriptions and basic elements of five main models

of CRM.

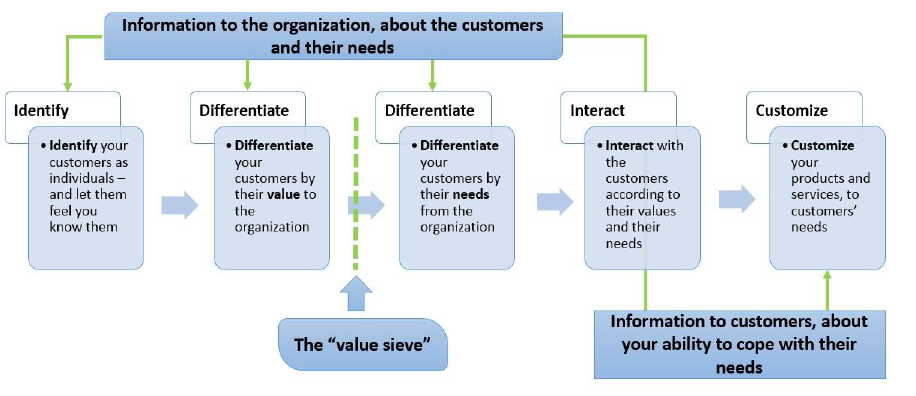

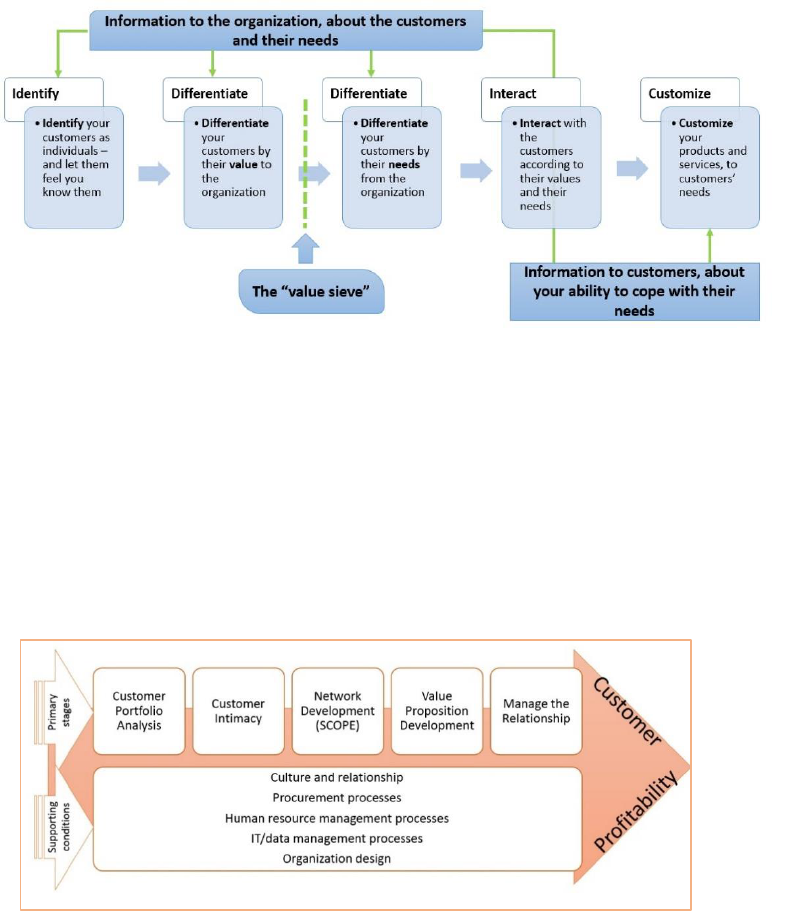

3.1 The IDIC model – Identify, Differentiate, Interact and Customize

The IDIC Model has been developed by Peppers and Rogers in 2004. According to its main

concept, companies should take four actions in order to build closer one-to-one relationships

with their customers: Identify, Differentiate, Interact and Customize. Relations between

mentioned actions are presented graphically in Figure 2. (Peppers & Rogers, 2004)

Figure 2. The IDIC model of CRM: Identify, Differentiate, Interact and Customize (Peppers & Rogers,

2004).

Four suggested actions are as follows:

25

1. Identify. The company should identify who are its customers and build a deep

understanding of them.

2. Differentiate. The company should differentiate its customers in order to identify those

who have or who will have the biggest value. The differentiation can allow the company

to formulate and implement customer specific individual strategies for different customers

or customer groups.

3. Interact. The company should interact with its customers in order to ensure that customer

expectations are understood. It allows also to evaluate customer relationships with other

suppliers or brands. Each successive interaction with a customer should take place in the

context of all previous interactions with that customer. A conversation with a customer

should pick up where the last one left off. Effective customer interactions provide better

insight into customer’s needs.

4. Customize. The company should tailor its offer and communications according to

expectations of its customers. In order to involve a customer in a relationship, the

company also should adapt some aspects of its behaviour toward a customer, based on

that individual’s needs and value. (Peppers, et al., 1999; Peppers & Rogers, 2004)

3.2 The CRM Value Chain

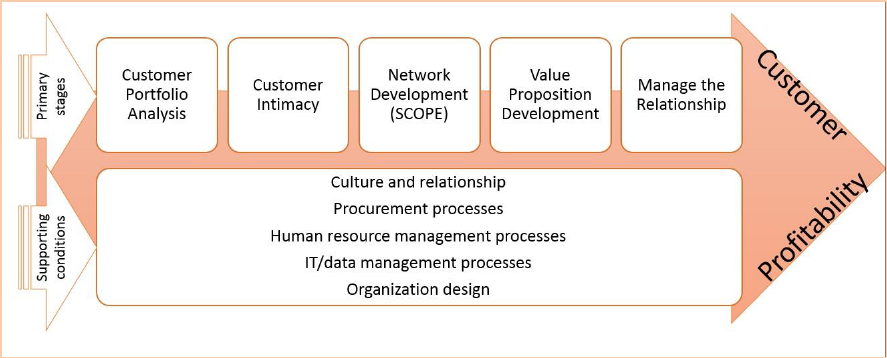

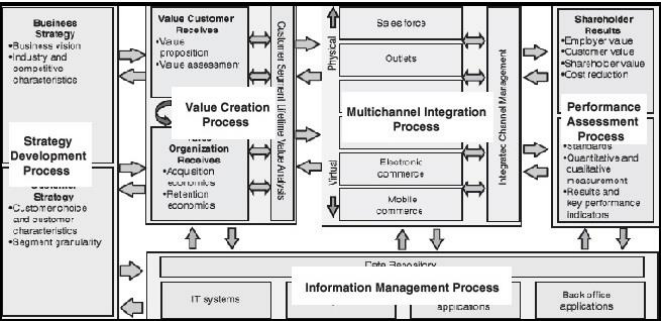

The CRM Value Chain is a model developed by Francis Buttle (see Figure 3). According to

Buttle, the “CRM Value Chain is a proven model which businesses can follow when

developing and implementing their CRM strategies. The ultimate purpose of the CRM value

chain process is to ensure that the company builds long-term mutually-beneficial

relationships with its strategically-significant customers”. (Buttle, 2004)

The model consists of five primary stages: customer portfolio analysis, customer intimacy,

network development, value proposition development and managing the customer lifecycle.

Those are supported by four conditions: leadership and culture, data and IT, people; and

processes.(See Figure 3).

26

Figure 3. The CRM value chain (Buttle, 2004).

Five primary stages create and deliver value propositions that acquire and retain profitable

customers. Four supporting conditions enable the CRM strategy to function effectively and

efficiently. (Buttle, 2004)

The five primary stages are as follows:

I. The “Customer Portfolio Analysis” step analyses the customer base to identify customers

to target with different value propositions. The main question to be answered on this phase

is “Who are our strategically significant customers?” for companies which have no

customer history, Buttle suggests to use segmentation approaches.

II. Choosing the right customer stage is followed by next, the “Customer Intimacy” step. It

involves processes of getting to know the selected customers as segments or individuals

and building a customer data-base which is accessible to all those whose decisions or

activities impact upon customer attitude and behaviour.

III. The “Network Development” step involves building a strong network of relationships with

employees, suppliers, partners and investors who understand the requirements of the

chosen customers.

IV. The “Value Proposition Development” step involves developing of propositions of mutual

value for the customer and the company which should be in compliance with the networks

from previous step.

V. The “Manage the Customer Lifecycle” stage stands for management of relationships with

customers. The focus here is on both structure and process. (Buttle, 2004)

27

Further Buttle (2004) suggests that CRM solutions cannot be transplanted into any

organisation in the absolute certainty that the business will flourish. CRM needs a supportive

culture as it is unlikely to yield dividends in companies which only pay lip service to customer

focus. Information technology, human resources and procurement processes should be

aligned with the CRM agenda. One of arguments to support this view is that CRM

implementation will not succeed in organisations wedded to product-based structures or

reward systems based on sales volume. (Buttle, 2004)

3.3 A conceptual framework for CRM strategy: The Five-Process Model

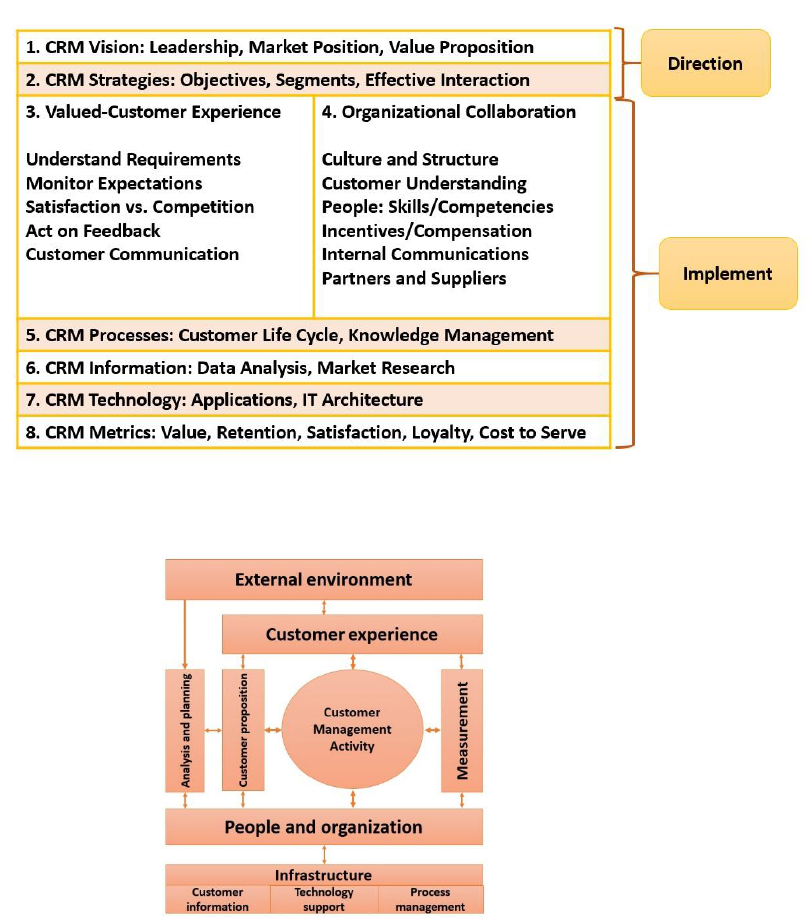

Figure 4. A Conceptual Framework for CRM Strategy (Payne & Frow, 2005; diagram; found on p.

171).

This model was developed by Payne & Frow in 2005 with an aim to identify the key generic

processes relevant to CRM. In their interactive research, Payne & Frow integrated a

synthesis of the literature with learning from field-based interactions with executives to

develop and refine the CRM strategy framework. The model was developed after workshop

with 34 highly experienced CRM practitioners, interviews with 20 CRM executives and six

executives from large CRM vendors. Payne and Frow emphasize the need for a cross-

28

functional, process-oriented approach that positions CRM at a strategic level. The

conceptual framework based on five key cross-functional CRM processes (a strategy

development process, a value creation process, a multichannel integration process, an

information management process, and a performance assessment process). The framework

explores the role and function of each element in the framework. Payne & Frow emphasize

that a single, process-based framework provides deeper insight into achieving success with

CRM strategy and implementation. (Payne & Frow, 2005)

The strategy development process includes the business strategy and the customer

strategy. The business strategy determines how the customer strategy should be developed

and how it should evolve over time. The customer strategy examines the existing and

potential customer base and identifies which forms of segmentation are the most

appropriate. (Payne & Frow, 2005)

The value creation process transforms the outputs of the strategy development process into

programs that both extract and deliver value. The three key elements of the value creation

process are (1) determining what value the company can provide to its customer; (2)

determining what value the company can receive from its customers; and (3) maximizing

the lifetime value of desirable customer segments by successful management of this value

exchange. (Payne & Frow, 2005)

The multichannel integration process is one of the most important processes in CRM. It

takes the outputs of the business strategy and value creation processes and translates them

into value-adding activities with customers. The multichannel integration process focuses

on decisions about what are the most appropriate combinations of channels and how to

ensure that customer experiences within those channels are highly positive. If a customer

interacts with more than one channel, this process creates and presents a single unified

view of the customer. (Payne & Frow, 2005)

The information management process is collecting, collating, and using customer data and

information from all customer contact points in order to generate customer insight and

appropriate marketing responses. The key material elements of the information

management process are the data repository, IT systems, analysis tools; and front office

and back office applications. (Payne & Frow, 2005)

29

The performance assessment process ensures that the organization’s strategic aims in

terms of CRM are being appropriately delivered and that a basis for future improvement is

established. This process can be viewed as having two main components: shareholder

results, which provide a macro view of the overall relationships that drive performance, and

performance monitoring, which provides a more detailed, micro view of metrics and key

performance indicators. (Payne & Frow, 2005)

3.4 The Gartner’s competency model: Eight Building Blocks of CRM

Figure 5: Eight building blocks of CRM (Gartner, Inc., 2001).

Gartner is the world's leading information technology research and advisory company.

Founded in 1979, Gartner is headquartered in Stamford, Connecticut, USA, and has 5,700

associates, including more than 1,435 research analysts and consultants, and clients in 85

countries. Company takes a significant place in CRM research. (Gartner, Inc., 2013)

The Gartner competency model (see Figure 5) suggests that companies need competencies

in main eight areas to company’s CRM initiative to be successful. Eight main areas of

competence are based on profile of the eight Fortune 1000 companies, which were noted

30

growing revenue year-after-year (all but one was profitable in 2000, which is the year of

research), and all ranked high in their respective industries. (Gartner, Inc., 2001)

Eight main competencies are CRM vision, CRM strategy, consistent valued customer

experience, organizational collaboration, CRM processes, CRM information, CRM

technology and CRM metrics. Those are described in Table 3.

Table 3. Eight main areas of competence. (cited from Gartner, Inc., 2001)

CRM Vision

Successful enterprises display inspirational leadership, building a

market position against competitors with defined value propositions

based on requirements, personified by the brand and communicated.

CRM Strategy

A successful enterprise should understand how the customer base can

be turned into an asset through the delivery of a customer value

proposition. It should provide objectives, segments and customers, and

it should define how resources will be used in interactions.

Consistent Valued

Customer

Experience

This involves ensuring that the propositions have value to the customer

and the enterprise, achieve the desired market position and are

delivered consistently across channels.

Organizational

Collaboration

This involves the transformation of culture, structures and behaviours to

ensure that staff, partners and suppliers work together to deliver what is

promised. Critical to ensuring end user acceptance of new behaviours

and enabling technology is a solid change management strategy.

CRM Processes

This area involves the management of the customer life cycle and

processes relative to analysis, planning and knowledge management.

CRM Information

Quality data is collected and used to make decisions supporting

business processes.

CRM Technology

Successful enterprises leverage data and information management,

customer-facing applications, and supporting IT infrastructure and

architecture to enable CRM. With an antiquated system and manual

processes, fulfilling customer needs is impossible.

CRM Metrics

It is important to track internal and external measures of CRM success

and failure. Increasingly, enterprises will begin to establish the key

elements of their value proposition and service delivery that really drive

customer loyalty — as the customer sees it. At the same time, they can

establish areas in which they are overdelivering on customer

requirements and, thus, can make cost savings without affecting

loyalty.

As Garner Research Inc. homepage states, “Gartner is the IT professional's best first source

for addressing virtually any IT issue because of our world-class, objective insight, the rapid

access to that insight, and the low cost compared to the impact and other alternatives”

(Gartner, Inc., 2013)

31

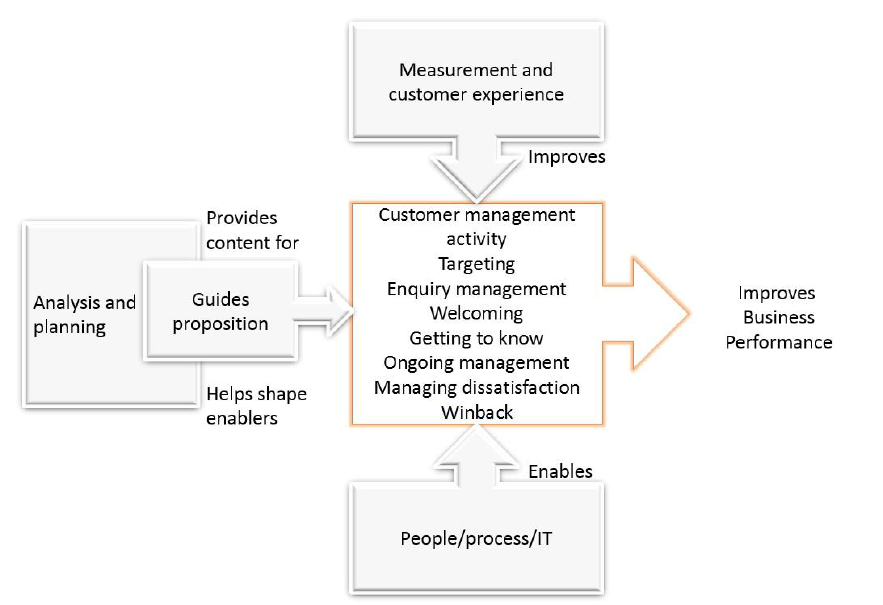

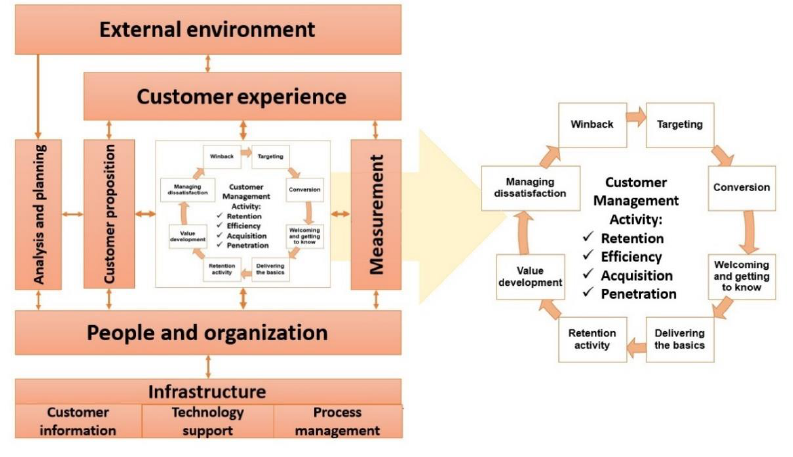

3.5 The QCi Model: The Customer Management Framework

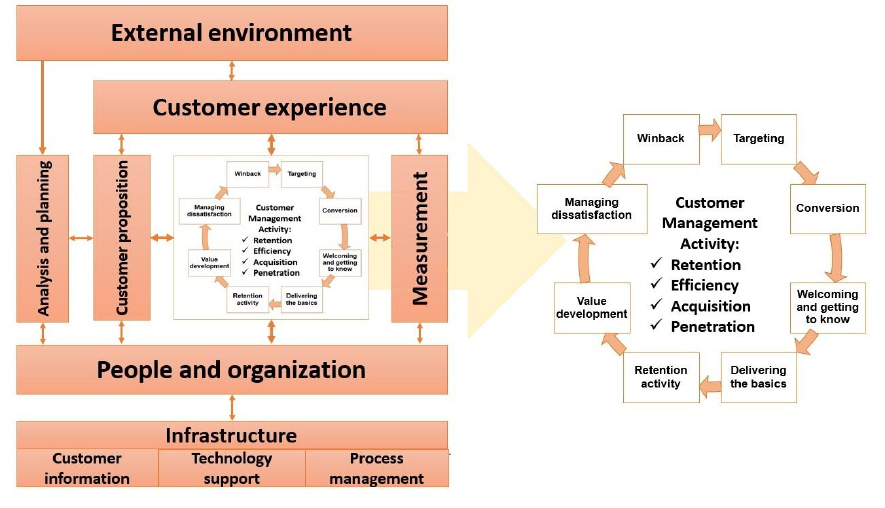

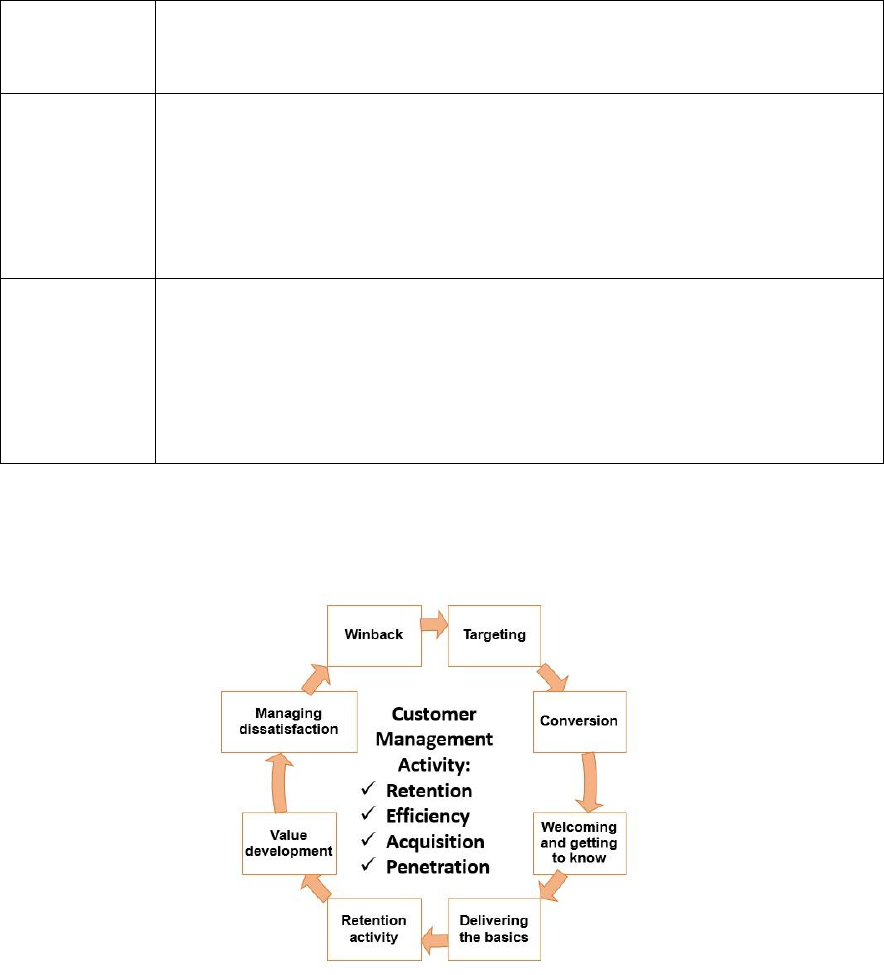

Figure 6: The QCi Customer Management Model (Woodcock, et al., 2003).

The QCi model is a product of consultancy firm “The Customer Framework”. Authors of this

model describe it as a customer management model, excluding the word "relationship". At

the heart of the model they put “customer management activity”, a set of processes that

companies need to implement in order to acquire and retain customers. The model

emphasizes significance of people performing “customer management activity” processes.

Technology is used to assist in those activities. The model has eight major elements –

analysis and planning, proposition, information and technology, people and organization,

process management, customer management activity, measuring the effect and customer

experience. (Woodcock, et al., 2003; The Customer Framework Ltd, 2011-2013)

The main value of this model for present research is that it puts customer management

activity at the heart of model, with people and organization as immediate supportive process.

Another strong point is that the QCi model omits using “relationship” part of CRM. As Ward

and Dagger have found, relationship strength varies “significantly between service products

and individual customers, and the impact of duration of relationship and the frequency of

purchase on relationship strength depends greatly on the nature of the service product”.

32

(Ward & Dagger, 2007, p.281) Therefore, this model will be the most suitable for adequate

assessment of service business.

Following Table 4. represents a brief overview of model’s main elements by its authors,

Woodcock, et al. (2003).

Table 4. The Customer Management Model: main elements. (cited from Woodcock, et al., 2003,

pp.12-18)

Analysis and

planning

Everything starts with understanding the value and behaviour of different

customers and different customer groups. Once a clear and comprehensive

understanding has been developed, customers and prospects need to be

segmented so that planning activity can be as effective as possible. This planning

will be focused on enabling the organization to REAP the value of its customer

base, focusing on retention, efficiency, acquisition and penetration (REAP).

Proposition

Once the customers to be managed (or explicitly not managed) have been

defined, propositions need to be developed that will match the needs of these

customers and that will be attractive to new customers. There will often be

different propositions for different groups, so a customer need’s research by

segments is needed. These propositions need to be defined at detailed level that

drives the experience the customer can expect in dealing with the organization,

its products, and its partners or channels. Development of service standards is a

useful tool at this stage. It is therefore critical that the propositions are

communicated effectively to both customers and the people who deliver them.

Information

and

technology

Technology exists to help organizations acquire, manage and use the vast

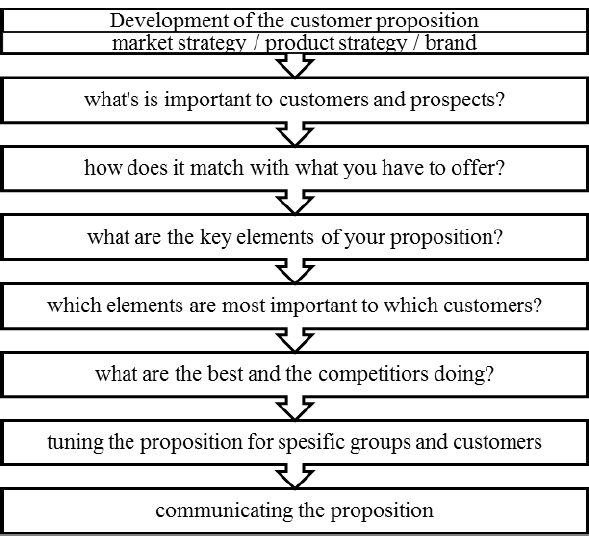

amount of information involved in managing customers. It is an enabler rather