14

S

ta retention, continued inflation

and the capability to provide a better

patient experience were just a few of

the challenges that eyecare professionals and

optical retailers faced in 2023. The 2024 VM

Top 50 U.S. Optical Retailers report is based

on calendar year 2023 locations and sales

provided by companies along with VM’s esti-

mates.

VM's

research with retailers revealed

that upgrades and investments in operations

and technology, including remote and tele-

COVER TOPIC

BY VM STAFF

health equipment, continued to gain traction

among the Top 50 in 2023.

Inflation concerns again appear to be at the

top of the list for many retailers, leading to

targeted goals such as decreasing the cost of

goods and maintaining current xed expens-

es. Sta retention was another challenging

issue, leading some to invest more dollars in

sta training and technology. Opportunities to

make quality care more aordable and acces-

sible, such as by investing in the development

of AI tools, were also mentioned by several

companies. Enhancing medical care delivery

to assist ECPs in providing comprehensive

eyecare solutions to patients was another

common goal cited by retailers.

Despite these challenges, 2023 still saw or-

ganic growth, including new store and oce

openings, among the Top 50 retailers. And,

this year, there are four companies on the VM

Top 50 for the rst time. The collective sales

of VM’s Top 50 U.S. Retailers rose 8 percent

in 2023 compared with 2022, to reach an es-

timated $20.1 billion from 16,369 locations.

The Top 10 retailers accounted for 84.5 per-

cent of overall Top 50 sales. n

More

Image Credit: Getty Images / Yutthana Gaetgeaw

VM’s 2024 Top 50 U.S. Optical Retailers

Revenues Show Healthy Growth Despite Economic Uncertainty

JUNE 2024 VISIONMONDAY.COM

Facebook.com/VisionMonday

@VisionMonday

16

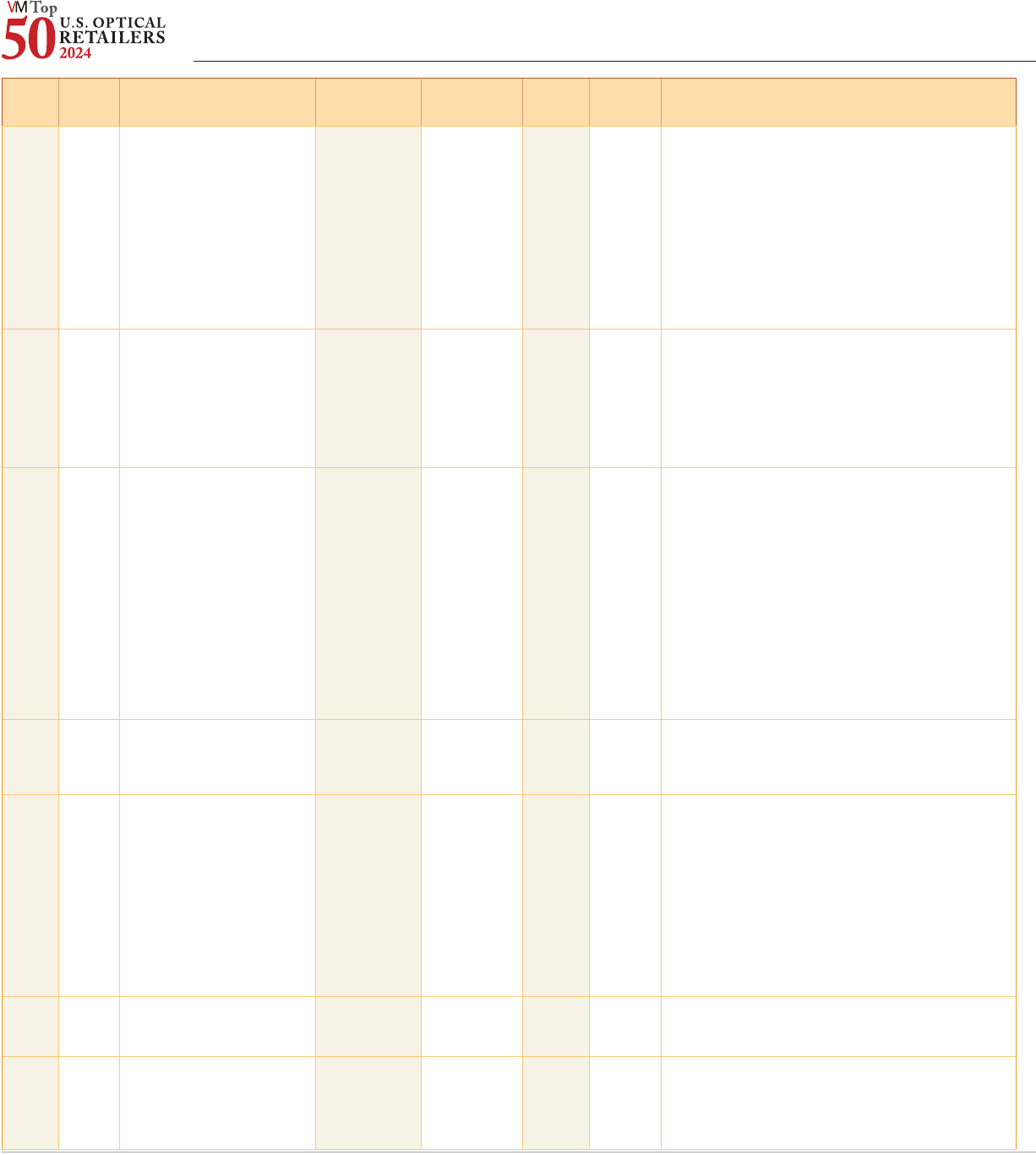

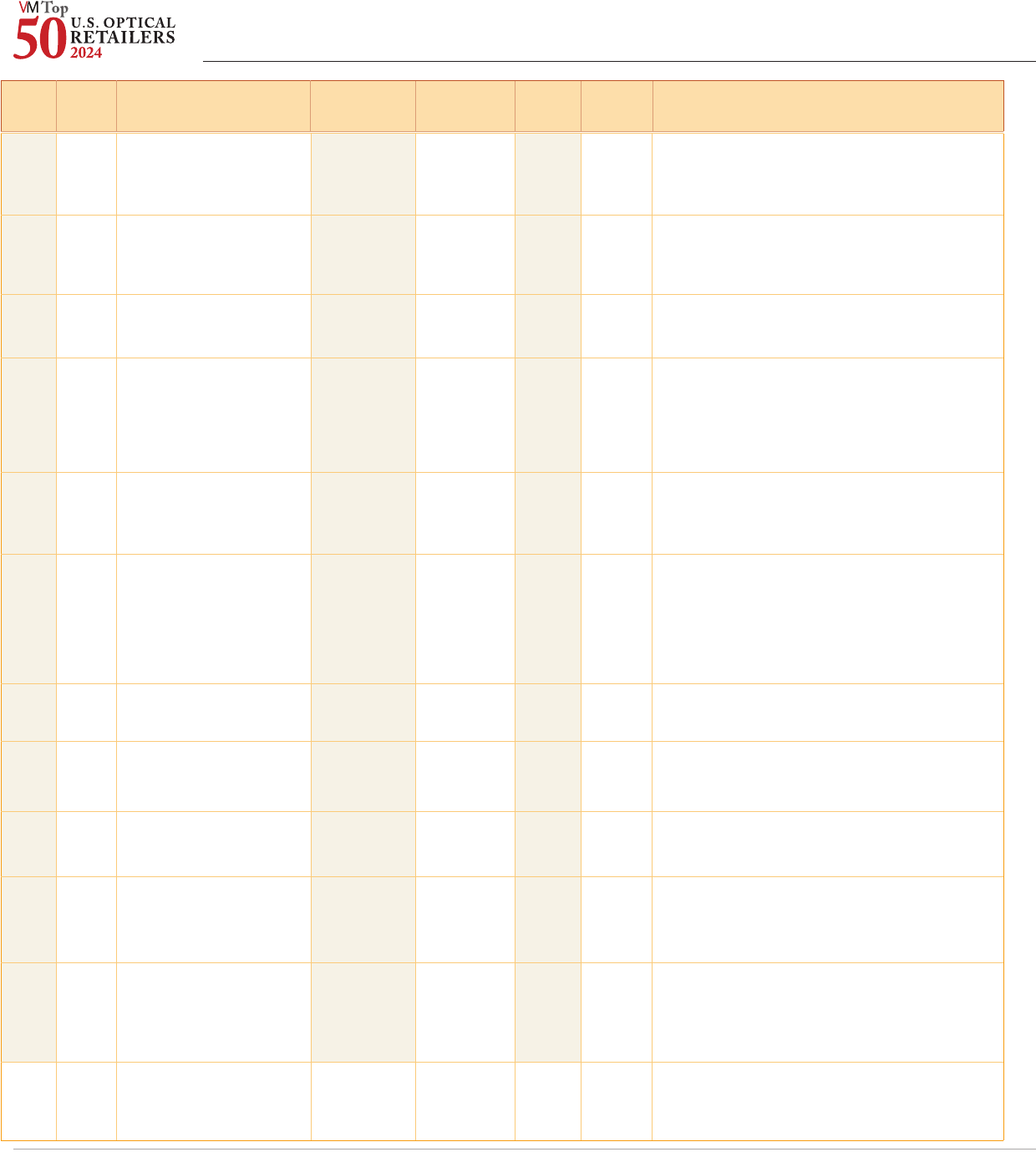

Key Optical Players Ranked by U.S. Sales in 2023

2023

Rank

2022

Rank

Retailer 2023 Sales

1

($ Millions)

2022 Sales

1

($ Millions)

2023

Units

3

2022

Units

3

Comments

1 1

Vision Source L.P. $2,938.0 $2,675.4 2,994 2,994

Vision Source included 2,994 practice locations in the U.S. with a

membership of 4,500 optometrists. They recently announced two

new programs: (1) The Associate OD Placement Program enables

members to offer employer-funded tuition reimbursement as

part of their associate OD compensation package; and (2) an

employee health care benefits program provides practice owners

with health plan options for themselves and their associates.

Vision Source is a part of Essilor of America, which is a division of

EssilorLuxottica. In accordance with franchise law, Vision Source

is a franchisor, and its members are franchisees who own their

respective practice(s). The collective revenue of those practices

are reported here. Essilor acquired Vision Source in 2015.

2 2

Luxottica Retail $2,620.0* $2,500.0* 2,185 2,173

Luxottica Retail is a part of the retail network of EssilorLuxot-

tica. Luxottica Retail store brands/DBAs in the U.S. and Puerto

Rico include, as of the end of Dec. 2023: LensCrafters (932 total

locations including 95 LensCrafters inside Macy’s); Pearle Vision

collectively 510 locations (Pearle corporate: 61 locations, Pearle

franchise: 449 locations); Target Optical (574 locations); For Eyes

(107 locations); Oliver Peoples (24 locations); Persol (1 location);

Ray-Ban (33 locations); OSA (3 locations); Alain Mikli (1 location).

3 3

National Vision Holdings, Inc $2,126.0 $2,005.0 1,413 1,354

National Vision (NVI), a publicly traded company on the Nasdaq

(EYE) exchange, is based in Duluth, Ga. It operated a total of 1,413

locations at the end of 2023, These include: America’s Best (957

locations); Eyeglass World (148 locations); Vision Centers inside

Walmart (225 locations); Vista Optical in select Fred Meyer Stores

(29 locations); Vista Optical in select military exchanges (54 loca-

tions). This year-end 2023 revenue includes revenues reported by

NVI in its Corporate & Other segment, which includes the results

of the e-commerce platform of 15 dedicated websites managed

by AC Lens. In 2023, NVI’s e-commerce business consisted of

six proprietary branded websites, nine third-party websites with

established retailers as well as mid-sized vision insurance provid-

ers. AC Lens handled site management, customer relationship

management and order fulfillment and also sold a wide variety of

contact lenses, eyeglasses and eye care accessories.

4 4

Walmart Inc. $2,025.0* $1,880.0* 3,421 3,422

VM estimates of Walmart’s Inc.’s optical business includes the

company-owned and operated Walmart optical departments

(2,875 locations as of the end of 2023) and Sam’s Club optical

departments (546 locations at the end of 2023).

5 5

EyeCare Partners LLC $1,728.0 $1,665.0 682 700

EyeCare Partners, a portfolio company of Partners Group,

finished the year with682ECP-affiliated locations,a mix of MDs

and ODs,that provide services spanning the eyecare continuum

in 18 states and 30 markets. Chris Throckmorton was named as

the company’s new chief executive officer in January 2024.

EyeCare Partners’ growing network of more than 1,000 doctors

and team members served more than 3.5 million patients across

18 states in 2023. It also opened the Cincinnati Eye Institute

Retina Clinic in 2023. EyeCare Partners operates under the follow-

ing banners, among others: Clarkson Eyecare, Nationwide Vision,

EyeCare Associates, eyecarecenter, The EyeDoctors Optometrists

and Grene Vision Group.

6 6

Costco Optical $1,683.9 $1,515.3 568 555

A part of Costco Wholesale (NASDAQ: COST), Costco Optical finished

the year with 568 optical departments, an increase of 13 locations

compared to 2022.

7 7

Capital Vision Services dba

MyEyeDr.

$1,400.0 $1,314.0 842 852

At the end of 2023, the MyEyeDr. organization, which is backed

by Goldman Sachs Merchant Banking, had 842 offices and 1,481

doctors. MyEyeDr. spent much of 2023 focusing on integrating

the 200 practices it acquired in 2021 and 2022, according to

company executives.

Source: VM's 2024 Top 50 U.S. Optical Retailers. When 2023 sales are the same for more than one com-

pany, the retailer with fewer 2023 U.S. stores is ranked first.

*VM ESTIMATE includes company sources and documents, reports and industry sources.

*=VM estimate. R=Revised N=Not on last year’s list.

Note: This year’s 2024 VM Top 50 U.S. Optical Retailers Report does not include references to Total U.S.

Market Sales.

1 Includes retailers’ product sales, professional services, managed vision benefit revenues and e-com-

merce sales when applicable. U.S. sales include Puerto Rico, not Canada. Numbers are for 12 months

ending Dec. 31, 2023.

2 The retailers and totals given for 2022 are different from what appeared on the June 2023 VM Top 50 list

because the Top 50 companies differ from year to year due to industry consolidation and other factors.

3 U.S. and Puerto Rico optical locations.

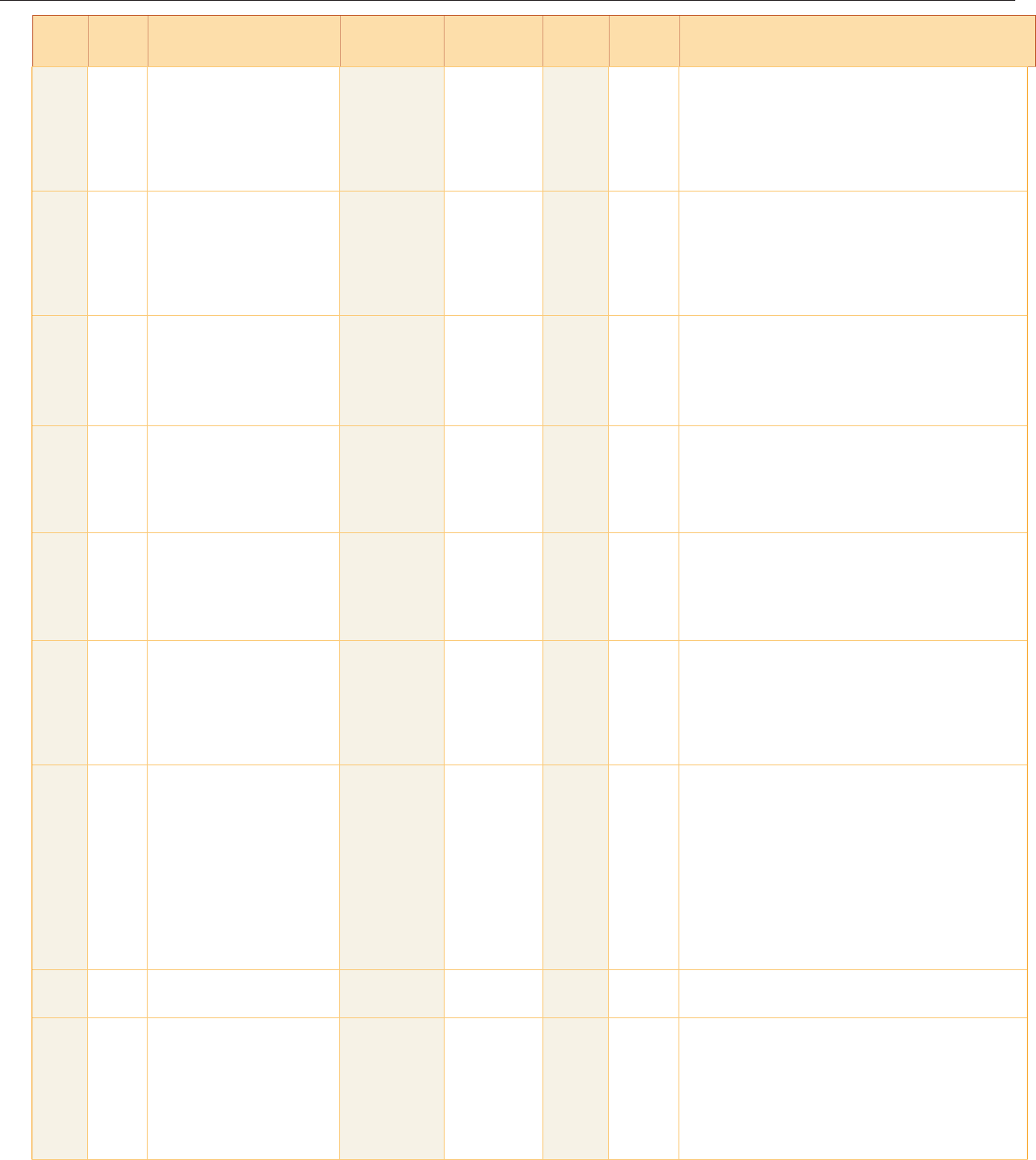

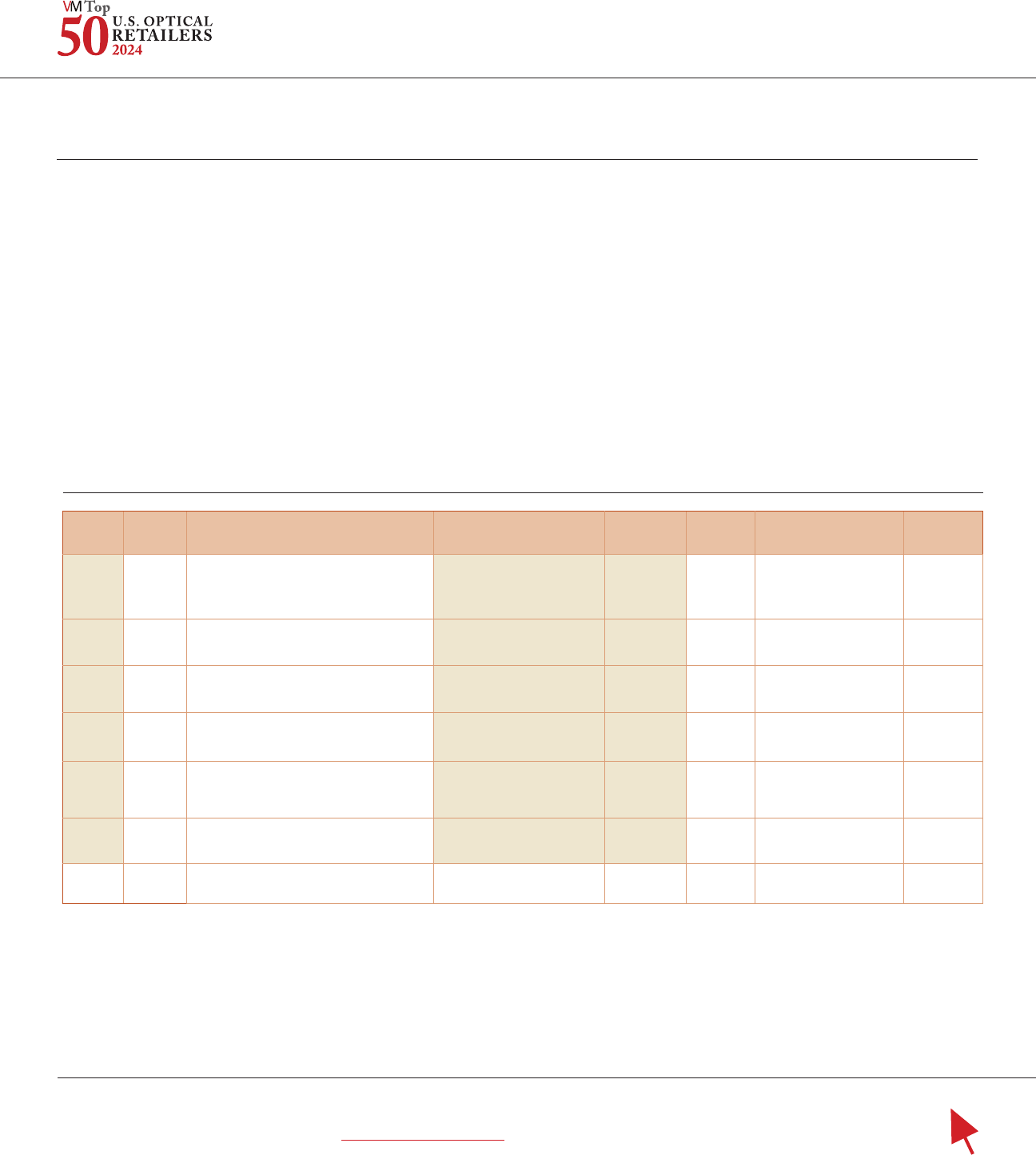

17

COVER TOPIC

Key Optical Players Ranked by U.S. Sales in 2023

2023

Rank

2022

Rank

Retailer 2023 Sales

1

($ Millions)

2022 Sales

1

($ Millions)

2023

Units

3

2022

Units

3

Comments

8 8 Visionworks of America, Inc. $1,173.0 $1,130.0 773 745

Visionworks closed the year with 773 locations, a net gain of 28

new locations. In 2023, the company focused on store expansion

in California and Washington state, and introduced the Vision-

works brand into three markets with multiple retail locations. Its

online scheduling tool and comprehensive exams now include

retinal imaging in all Visionworks locations. Visionworks is a divi-

sion of VSP Vision, which acquired Visionworks in October 2019.

9 9

Warby Parker $659.0* $598.1 232 200

Warby Parker (NYSE:WRBY) ended 2023, its second full year as

a public company, with 237 stores across the United States and

Canada, including 40 stores opened during the year. Full-year net

revenue totaled $669.8 million, including both online sales and

those from North American storefronts. Warby Parker operates 5

locations in Canada; this year's chart reflects VM's estimates for

the company's U.S. sales.

10 11 AEG Vision $650.0 $450.0 425 350

AEG Vision, backed by Riata Capital Group, continued its steady

growth in 2023 generating 6 percent comp sales in its base prac-

tices while adding 75 new practices, bringing its total to 425, and

integrated them onto the company’s common platform. Ninety-five

percent of the practice network is on a common platform which

includes technology, product supply chain and back-office support.

11 10 Keplr Vision $482.0 $455.0 278 284

Currently, across its 278 locations, with 605 optometrists, Keplr

reports that for calendar year 2023 and into 2024, the group has

been “maintaining above-industry averages for organic comp

growth.” In March 2023, the group announced that it had closed

$80 million in additional funding from existing investors includ-

ing Imperial Capital and Golub.

12 12

Eyemart Express $366.2 $345.0 246 241

National optical retailer Eyemart Express, backed by FFL Partners,

ended 2023 with revenues of $366.2 million at 246 locations.

The retailer expanded its footprint in Indiana with the opening

of four new stores in May of 2023. The new storefronts in Avon,

Columbus, Evansville and Fishers marked the company’s first

presence in the Evansville and Indianapolis markets.

13 13

Now Optics Holdings, LLC $312.1 $289.0 277 287

Now Optics Holdings LLC operates Stanton Optical and MyEye-

Lab locations in 30+ states and continued its investments in

proprietary telehealth and strategic patient-care technologies.

In 2023, the group rebranded over 150 stores from My Eyelab to

Stanton Optical. Now Optics operated 273 Stanton Opticals (196

company-owned and 77 franchised locations) and 4 MyEyeLab

(franchised locations).

14 15 Shopko Optical $168.0 $142.0 142 141

Shopko Optical finished 2023 with 142 locations. The company

acquired two locations during the year, Romanak Vision in July

2023, and Badger Optical in August 2023. It also integrated a

number of acquisitions in 2023 along with continuing its strategy

of providing optical services to underserved areas. The company

also continued growth with new de novo centers in existing mar-

kets and acquisitions in new markets. In June 2024, the Fielmann

Group, a global eyewear provider, announced that it has entered

into a definitive agreement in which its U.S. subsidiary, Fielmann

USA, will acquire 100 percent equity ownership in Shopko

Optical, from Monarch Alternative Capital LP. The transaction is

expected to close in the third quarter of 2024.

15 14 Cohen's Fashion Optical $150.0 $150.0 121 123

Cohen's Fashion Optical operated a total of 121 units, including

13 corporate locations and 108 franchised locations.

16 17 VSP Ventures $131.5 $119.0 91 84

VSP Ventures grew by acquisition in 2023 and operated 91

offices, seven more than the prior year. It noted, “In addition

to adding seven new additions to our network, we continued

to fine-tune our operational approach to better support our

practices and the patients and staff within them.” The company

said that its primary investment focus remains on expanding and

supporting its network of practices. The group was established

by VSP Vision in 2019.

18

17 18

New Look Vision Group (US) $117.0 $110.4 66 61

New Look Vision Group (US) is a part of Canada-based New Look

Vision Group which operates under a number of banners in

Canada. The group’s network is made up of 490 locations across

Canada and the U.S. As of year-end 2023, the U.S. business

had 66 locations, an increase of five locations from a year ago.

It includes the following U.S. banners: Edward Beiner (13 units),

Morgenthal Frederics (13 units), Robert Marc NYC (7 units), Black

Optical (6 units), Georgetown Optician (5 units), Europtics (3

units), The Eye Gallery (3 units), other DBAs (16 units).

18 N

Fielmann USA, Inc. $112.0 $103.5 82 82

Fielmann USA, Inc., based in Detroit, Mich. is a subsidiary of

the Fielmann Group AG (Bloomberg: FIE), the international

omnichannel eyewear company, which entered the U.S. market

with the acquisition of SVS Vision as well as Befitting, an online

eyewear business which has no stores, in 2023. SVS Vision

locations continue to operate under that name. The 2022

revenue and unit numbers listed in the Top 50 chart are from

SVS Vision. This month, the Fielmann Group announced that it

has entered into a definitive agreement in which Fielmann USA

will acquire 100 percent equity ownership in Shopko Optical, an

optical retailer based in Green Bay, Wis., from Monarch Alterna-

tive Capital LP. The transaction is expected to close in the third

quarter of 2024.

19 19 Total Vision LLC $110.0* $110.0 58 59

Total Vision LLC, based in Southern California, is backed by New

York City-based Bregal Partners and operated 58 offices as of

12/31/2023.

20 16

Texas State Optical $110.0 $120.7 93 104

Headquartered in Houston, Texas, the company invested in

AI-assisted digital advertising in 2023, as well as technology that

enables remote eye exams, with plans to expand these capabili-

ties this year.

21 22

Eye Doctors Optical Outlets $97.0 $92.0 56 56

Eye Doctors Optical Outlets was acquired by iCare Health Solu-

tions, a VSP Vision company, in August 2023.

22 23

BJ's Optical Centers $95.0* $90.0* 231 227

BJ’s Optical Centers are a part of BJ’s Wholesale Club Holdings,

Inc (NYSE:BJ). The company has announced that it plans to open

about 10 locations per year for the next several years, including

growth in existing markets as well as growth in new markets.

23 21 Emerging Vision, Inc. $91.6 $93.8 106 109

Emerging Vision ended 2023 with 106 locations. These included

Optica (7 locations); The Eye Gallery (3 locations); Sterling Opti-

cal with 2 company-owned units and 52 franchised locations;

The Artful Eye (1 location); and Site For Sore Eyes, with 41 fran-

chised locations. The company noted that in 2023 it remodeled

two Optica locations and opened two new franchise stores. It

also continued upgrades in equipment, including telehealth.

24 26 Vision Associates $85.2 $80.6* 212 224

Vision Associates manages optical dispensaries within ophthal-

mology practices and is a business unit of EssilorLuxottica.

25 24 Henry Ford OptimEyes $83.2 $83.2 22 22

Henry Ford OptimEyes, part of Henry Ford Health Systems, fin-

ished the year with 22 locations and revenue of $83.2 million.

The company also named Michael Dunn as vice president in 2024.

26 25 U.S. Vision $75.6 $82.2 302 323

U.S. Vision, owned by Lincoln Road Advisors since March 2021,

operated a total of 302 locations in 2023. These included JC

Penney Optical (177 locations), Boscov’s Optical (43 locations),

Meijer Optica (51 locations), Army & Air Force Exchange Services

(AAFES) (22 locations) and Forward Vision (9 units).

27 27 Marion Eye Centers and

Optical

$49.5 $47.9 32 32

Marion Eye Centers and Optical offers ophthalmology and optomet-

ric services and dispensaries to patients, and finished 2023 with 32

U.S. locations. The company, which also operates a single Ameri-

can Digital Labs, noted its expansion of lab services during 2023 as

well as investment in updated lab manufacturing equipment.

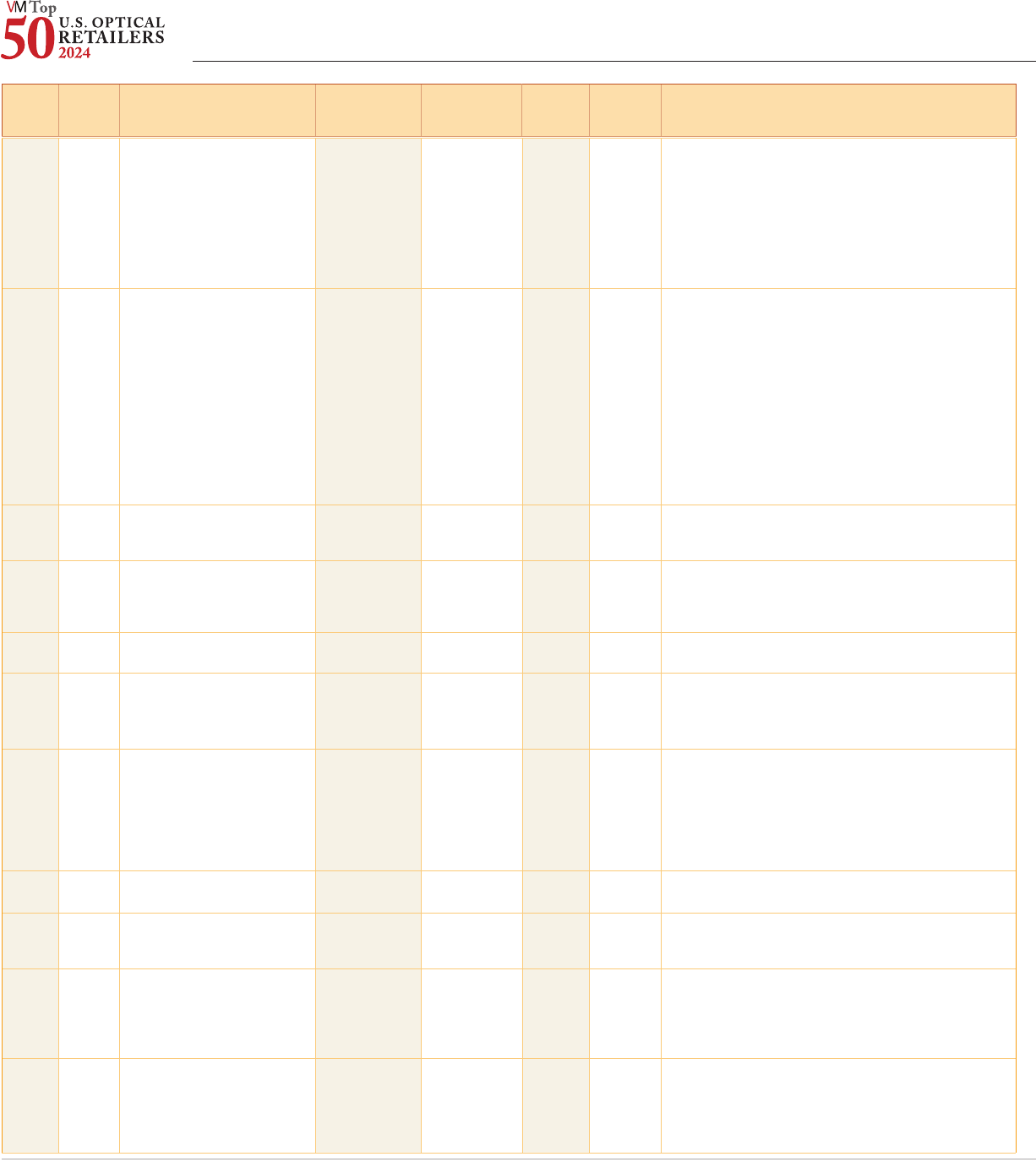

2023

Rank

2022

Rank

Retailer 2023 Sales

1

($ Millions)

2022 Sales

1

($ Millions)

2023

Units

3

2022

Units

3

Comments

Key Optical Players Ranked by U.S. Sales in 2023

Source: VM's 2024 Top 50 U.S. Optical Retailers. When 2023 sales are the same for more than one com-

pany, the retailer with fewer 2023 U.S. stores is ranked first.

*VM ESTIMATE includes company sources and documents, reports and industry sources.

*=VM estimate. R=Revised N=Not on last year’s list.

Note: This year’s 2024 VM Top 50 U.S. Optical Retailers Report does not include references to Total U.S.

Market Sales.

1 Includes retailers’ product sales, professional services, managed vision benefit revenues and e-com-

merce sales when applicable. U.S. sales include Puerto Rico, not Canada. Numbers are for 12 months

ending Dec. 31, 2023.

2 The retailers and totals given for 2022 are different from what appeared on the June 2023 VM Top 50 list

because the Top 50 companies differ from year to year due to industry consolidation and other factors.

3 U.S. and Puerto Rico optical locations.

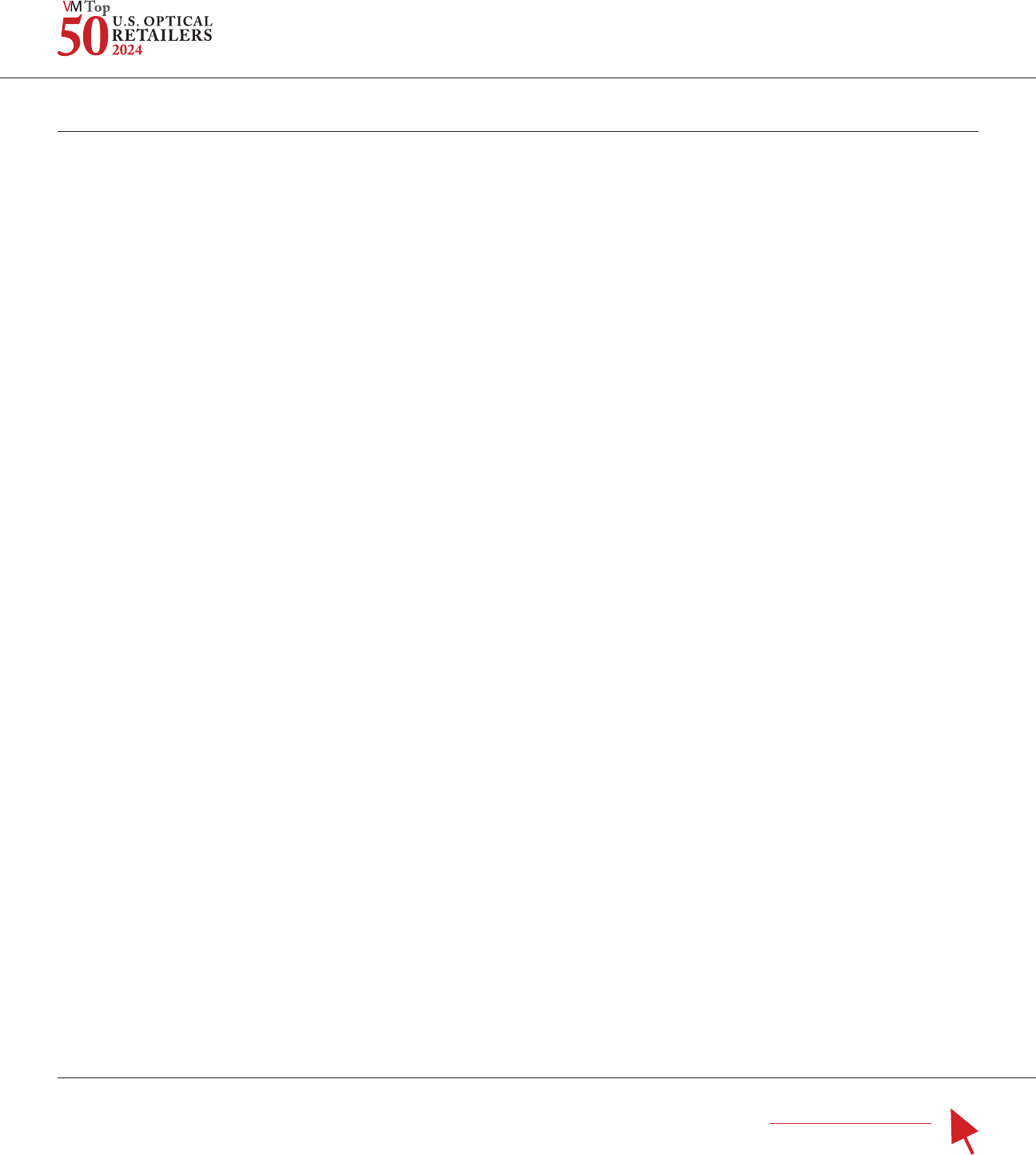

19

28 28 Wisconsin Vision, Inc. $47.0 $41.0 38 38

Wisconsin Vision Inc. operated 38 locations throughout Wiscon-

sin as of 12/31/2023. It also operates its own lab, which only

services its locations. Total sales do not include lab revenue.

29 29 Lumina Vision Partners $45.0* $40.0* 26 24

Arizona-based Lumina Vision Partners expanded from 24 stores in

2022 to 26 locations in 2023.

30 33 Dr. Tavel Family Eye Care $41.0 $35.0 24 24

Dr. Tavel Family Eyecare is a subsidiary of City Optical Company.

The company expanded 2 of its busiest locations this year, taking

capacity up to 3 and 4 lanes, and invested in lab equipment to

perfect the manufacturing process.

31 30 Today’s Vision Licensing

Corporation

$40.0 $40.0 50 48

The company reported opening offices with its model/trade-

mark while adding existing offices that align with its mission

statement. Targets for 2024 have multiple offices under LOI. The

company is operated by independent optometrists; managing

director is Aaron Oliver, chairman is April Oliver, OD.

32 32 SEE, Inc. $39.6 $37.5 42 43

SEE (Selective Eyewear Elements) Eyewear was conceived

in 1998 by founder Richard Golden as a new type of optical

boutique business. At the end of 2023, it operated 42 locations

across the country in major markets emphasizing fashion, on-

trend eyewear, sunwear and accessories.

33 N InFocus Eyecare $26.4 N 23 N

Headquartered in Dayton, Ohio, InFocus Eyecare, backed by Re-

gal Healthcare Capital Partners, had a total of 23 stores, including

the acquisition of 15 units made within the calendar year 2023.

They reported making investments in infrastructure of systems

and processes, with lens and lab, frame distribution, and contact

lens ordering among them, as well as team learning and sharing.

34 34 J.A.K.Enterprises, Inc. dba

Bard Optical

$21.0 $22.0 21 21

J.A.K. Enterprises does business as Bard Optical, with 21 loca-

tions in Illinois. The company noted, “We closed an underper-

forming location in the Peoria, Ill. market and opened a dynamic

office in Quincy, Ill.” The company said it is planning to open two

new locations in 2024.

35 N Acuity Optical / Acuity Eye

Group

$20.3 N 40 N

Acuity Optical/Acuity Eye Group's team of optometrists, ophthal-

mologists and retina doctors provide patient care and compre-

hensive services to patients throughout California’s Arcadia,

Monrovia, Sierra Madre regions and surrounding communities.

The group’s eyecare specialists treat retina disease, cataracts

and glaucoma. In 2023, the group’s 40 locations drove sales

over 14 percent, creating a stable business model that could be

replicated, company executives told VM.

36 N VisionFirst $18.2 N 18 N

VisionFirst has been providing professional eyecare services to

families in Central Kentucky and Southern Indiana since 1973. In

2016, VisionFirst Eye Care transitioned to becoming an employee-

owned practice. Today, VisionFirst has a team of 38 optometrists

and nearly 200 staff members. In 2023, there were 18 VisionFirst

offices located throughout the Kentuckiana area. Last year, the

group celebrated the addition of the VisionFirst Pediatric Eye Care

Center, company executives said.

37 38 Maine Optometry, PA $16.4 $14.2 7 7

Providing a full range of eyecare and optical services at its seven

locations, the company reported continued growth and the

onboarding of two new associate doctors. A remodeling of the

Freeport location included a brand new optical, front desk and

new exam lanes to support three full-time doctors

38 37 Clarity Vision, LLC $15.8 $14.3 6 6

The North Carolina company operated six locations via a fran-

chised model in 2023. The company said it increased the number

of doctors to 22, allowing for more expansion of eyecare services.

39 39

Thomas Eye Group $15.1 $13.0 15 17

Thomas Eye Group (TEG) operated 15 offices in 2023. The company

noted it made a pivotal investment in broadening the scope of their

eyecare services across the metro-Atlanta region. As an integrated

care provider, TEG’s focus was on enhancing medical care delivery

and extending the reach of their doctors to provide comprehensive

eyecare solutions. In October of 2023, TEG acquired Eye Q Vision, a

single-location practice located in Cumming, Ga.

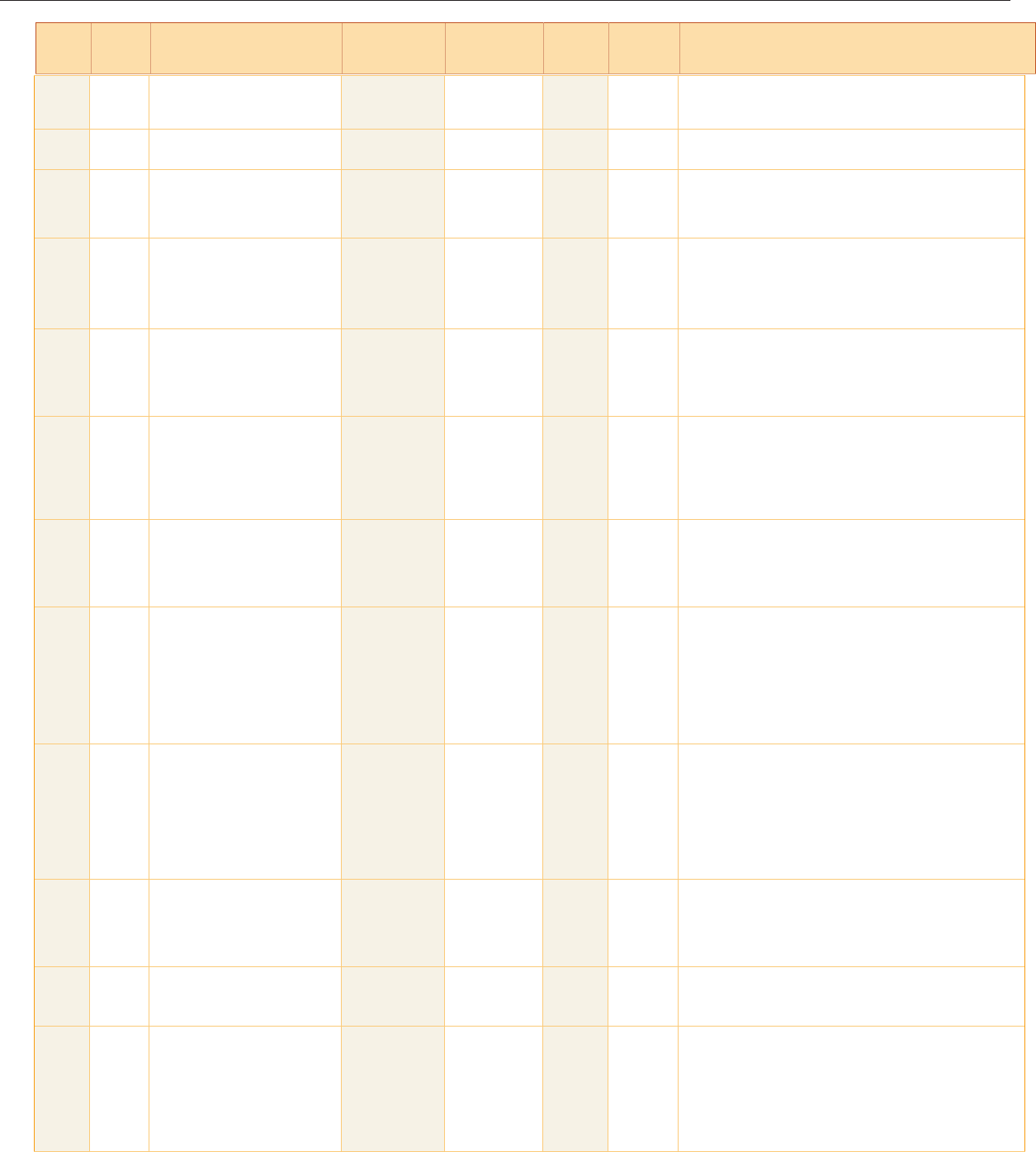

2023

Rank

2022

Rank

Retailer 2023 Sales

1

($ Millions)

2022 Sales

1

($ Millions)

2023

Units

3

2022

Units

3

Comments

Key Optical Players Ranked by U.S. Sales in 2023

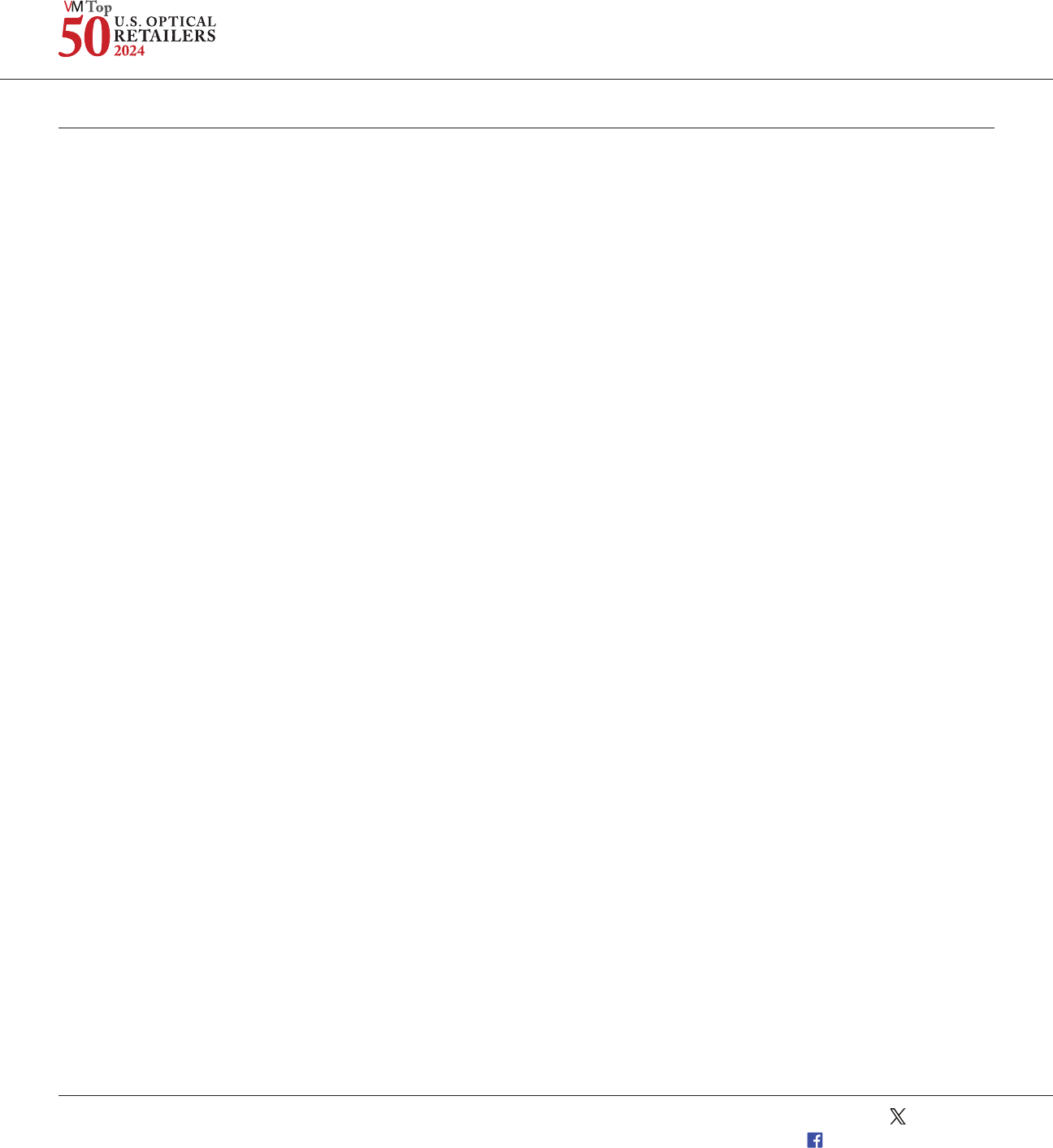

COVER TOPIC

22

2023

Rank

2022

Rank

Retailer 2023 Sales

1

($ Millions)

2022 Sales

1

($ Millions)

2023

Units

3

2022

Units

3

Comments

40 40 DePoe Eye Center $13.6 $12.8 12 12

DePoe operated 12 stores in 2023. The company said it acquired

Fayette Eye Center in Fayetteville, Ga. in December of last year.

DePoe said in 2023 it worked diligently to streamline its lab, bill-

ing and insurance departments.

41 44 Optyx $13.5 $10.5 13 11

NY-based Optyx operated a total of 13 locations in 2023, com-

pared with 11 locations in 2022. The company, with locations

in New York City and Long Island, offers the latest in eyewear

technologies and a variety of luxury, brand name frames.

42 35 Standard Optical Company $13.0 $20.4 15 21

Standard Optical Company included 14 StandardOptical and 1

Opticare Vision Services location as of 12/31/2023. The company

closed six locations in July 2023.

43 41

Big City Optical $12.5 $12.0 17 16

Chicago-based Big City Optical operated 17 stores in 2023. The

company noted its focus in 2023 was on internal non-store

departments. Changes were made in accounting, HR and market-

ing to improve overall support for the store teams and to create

a better experience for patients. The company is planning to

expand its tele-optometry services in 2024.

44 45 True Eye Experts $12.2 $10.4 9 8

Based in Tampa, Fla., True Eye Experts operated nine stores in 2023.

In July of last year, the company acquired Tuskawilla Family Eyecare

in Winter Springs, Fla. Last year, their focus was on creating in-

office, patient-facing experience processes, and training their staff.

45 46 Levin Eyecare $12.1 $10.2 9 9

Levin Eye Care offers a range of optical and medical services from

optometrists and ophthalmologists across nine offices in the Bal-

timore, Md. area. Levin Eyecare said it opened a de novo location

that integrated ophthalmology and optometry in mid 2023. The

company said two key priorities in 2024 are to ensure standard-

ization of clinical workflow/patient experience, and to invest in a

broader management team for continued growth.

46 43 Eye Associates $11.3 $10.6 8 8

Based in Overland Park, Kans., Eye Associates operated eight

locations in 2023.

47 47

Eye Surgeons of Richmond, Inc.

/ Virginia Eye Institute

$10.6 $10.1 7 7

Virginia Eye Institute (VEI) is a comprehensive eyecare organiza-

tion providing a wide range of ophthalmology, optometry, and

optical services in seven locations across central Virginia.

48 42 Eyecare Plus $10.2 $10.8 8 8

Eyecare Plus operated eight offices in Tennessee in 2023, and

reported they focused on growing their education programs with

their opticians.

49 49

Missouri Eye Consultants $10.1 $9.4 7 7

Based in Columbia, Mo., Missouri Eye Consultants operated seven

offices at the end of 2023. The company said in 2023 it “concen-

trated on decreasing the cost of goods and maintaining current

fixed expenses in a time of significant increased inflation.”

50 50

Envision Professional Group $8.1 $7.6 4 4

Envision Professional Group, based in Marion, Va., operates

as Envision Eye Care with four locations as of the end of 2023.

The focus for last year was on team culture, staff retention and

increasing revenues. Envision Eye Care “invested in new refract-

ing technology to allow us to increase throughput last year,”

company executives said.

TOTAL $20,111.7* $18,628.9*

2

16,369 16,143

2

Key Optical Players Ranked by U.S. Sales in 2023

Source: VM's 2024 Top 50 U.S. Optical Retailers. When 2023 sales are the same for more than one com-

pany, the retailer with fewer 2023 U.S. stores is ranked first.

*VM ESTIMATE includes company sources and documents, reports and industry sources.

*=VM estimate. R=Revised N=Not on last year’s list.

Note: This year’s 2024 VM Top 50 U.S. Optical Retailers Report does not include references to Total U.S.

Market Sales.

1 Includes retailers’ product sales, professional services, managed vision benefit revenues and e-com-

merce sales when applicable. U.S. sales include Puerto Rico, not Canada. Numbers are for 12 months

ending Dec. 31, 2023.

2 The retailers and totals given for 2022 are different from what appeared on the June 2023 VM Top 50 list

because the Top 50 companies differ from year to year due to industry consolidation and other factors.

3 U.S. and Puerto Rico optical locations.

COVER TOPIC

JUNE 2024 VISIONMONDAY.COM

Facebook.com/VisionMonday

@VisionMonday

A 10-Year Perspective on VM’s Top 50 U.S. Optical Retailers

B

eginning in 2023, Vision Monday began tak-

ing a 10-year perspective on the VM Top 50

U.S. Optical Retailers. The growth of the top retail

groups and companies has shown a consistent

upward trajectory over the last 10 years, with the

exception of two years when the retail revenues

clocked in at double-digit growth.

Revenues for 2019 showed a healthy 10 percent

increase compared with 2018, and there was no

sign that year that trouble was on the horizon be-

fore the COVID 19 pandemic kicked into high gear

in March of 2020. Numbers posted for calendar year

2020 were understandably anemic, when global,

pandemic-driven forces led to a 5 percent drop in

revenue compared with the year before. By the end

of 2021, though, retail revenues had made a historic

recovery, showing a 21 percent gain year-over-year.

Consolidation, either through mergers or out-

right acquisitions, has been a hallmark of VM’s

signature report, especially in the last 10 years as

private equity-backed companies have played a

pivotal role in the expansion of the retail industry,

and 2023 was no exception. Many retail executives

reported to VM that their businesses expanded

last year via the addition of independent practices

and retail groups.

As in years past, the numbers tell the story—for

calendar year 2023 the VM Top 50 reached a collec-

tive estimated $20,111.7 million for the 50 retailers,

a healthy 8 percent gain over the prior year. n

Source: VM Estimates

Vision Monday’s Top 50 Sales (2014 to 2023)

Source: VM Estimates

Vision Monday’s Top 10 Sales as a % of Top 50 Sales (2014 to 2023)

($ in millions)

24

JUNE 2024

COVER TOPIC

Download a PDF of prior years of VM Top 50 U.S. Optical Retailer Reports and analysis at

www.VisionMonday.com under the VM Reports category by clicking on Top 50 Retailers.

Rank

2023

Rank

2022

Mass Merchant

(Operator)

2023 Retail Sales

($ in Millions)

2023

Units

1

Class 2022 Retail Sales

($ in Millions)

2022

Units

1

1 1 Walmart

Walmart Vision Centers

National Vision

$1,970.0*

$1,819.0*

$151.0

3,100

2,875

225

MM $1,852.0*

$1,700.0*

$152.0

3,105

2,875

230

2 2 Costco Optical

Costco Wholesale

$1,683.9 568 WC $1,515.3* 555

3 3 Target/Super Target

Luxottica Retail

$525.6 * 574 MM $466.5* 562

4 4 Sam’s Club

Walmart Inc.

$206.0 * 546 WC $180.0* 547

5 5 BJs Optical Centers

BJ’s Wholesale Club Holdings Inc.

$95.0 * 231 WC $90.0* 227

6 6 Fred Meyer

National Vision

$11.0 29 MM $11.5 29

Totals $4,491.5* 5,048 $4,115.3* 5,025

Source: VM’s 2024 Top 50 Optical Retailers

*=VM Estimate MM=mass merchant WC=warehouse club

1 optical locations

Leading Mass Merchants, Clubs With Optical Departments

Mass Merchants and Warehouse Clubs Reflect a Collective 9.1 Percent Sales Gain in 2023

NEW YORK—Despite inflation keeping a rm grip on

the economy throughout most of 2023, the lead-

ing mass merchants and warehouse clubs with

optical departments showed an increase in dollar

sales for the year based on their reports and VM’s

estimates, which reflected a collective 9.1 percent

increase for the year. Sales of these businesses

reached $4,491.5 million for 2023 compared with

$4,115.3 million in the prior-year period.

Some of the gains came through strong comps

and others through additional store openings.

The collective store count among these retail-

ers rose from 5,025 in the 2022 calendar year to

5,048 in 2023.

Walmart’s Vision Centers, those operated by

the retailer as well as those operated by an agree-

ment with National Vision, saw a slight decrease

in units but a 6.4 percent increase in sales.

National Vision Holdings, Inc. ended its partner-

ship with Walmart Inc. in February 2024. This in-

cluded supplying and operating Vision Centers

in select Walmart stores, providing contact lens

distribution and related services to Walmart and

its aliate, and arranging for the provision of op-

tometric services at certain Walmart locations in

California.

Sam’s Club had one fewer location in 2023 while

Fred Meyer’s optical departments remained the

same in the number of its locations.

Costco Optical opened 13 new locations last

year, and Target Optical opened 12 more depart-

ments than in the prior year. BJ’s Optical opened 4

additional locations in 2023. n

26

30

JUNE 2024

VISION SOURCE L.P.

Vision Source, a North American network of

independent private practice optometrists,

has once again found itself at the top of this year’s VM

Top 50 Optical Retailers list. Founded in 1991 with a

focus on and commitment to the long-term success of

independent optometry, the organization in calendar

year 2023 reported 2,994 practice locations in the

U.S. with a membership of 4,500 optometrists and

sales of $2.938 billion. At The Exchange 2024, held

in April, Vision Source announced two new programs

that expand on its oerings to members: an Associate

OD Placement Program and an employee health care

benets program.

The OD Placement Program, a student loan debt relief

initiative, enables Vision Source members to feature

employer-funded tuition reimbursement as part of their

associate OD compensation package. The program

takes a proactive approach to helping private practice

owners add associate doctors, allowing Vision Source

members to access up to $150,000 in membership fee

credits to earmark for associate doctor student loan

repayment, along with support resources to bring on

highly motivated professionals with the desire to pro-

vide patient care within a private practice setting.

In addition, an employee health care benets

program was introduced that provides practice owners

with health plan options for themselves and their

associates. All members have access to this program,

the company noted, which at time of oering included

medical insurance benets. Practices with at least two

employees can participate.

"We leverage our member network framework to

secure options for our Vision Source member practice

owners versus what is traditionally available to them

on the small employer group market,” executives

stated. "Vision Source is committed to making ad-

vancements accessible to all practice owners. Our new

programs, like the Associate OD Placement Program

and Employee Healthcare Benets, aim to empower

practices of all sizes."

Vision Source is a part of Essilor of America, which

is a division of EssilorLuxottica. In accordance with

franchise law, Vision Source is a franchisor, and its

members are franchisees who own their respective

practice(s). The collective revenue of those practices

is reported in the VM Top 50. Essilor acquired Vision

Source in 2015.

LUXOTTICA RETAIL

Part of the EssilorLuxottica retail network,

Luxottica Retail (Reuters: ESLX.PA) main-

tained its position this year in the #2 slot of the VM Top

50 ranking. Oering a diverse selection of brands, the

group added 12 units, bringing total storefronts to 2,185,

and demonstrated an approximate 4.8 percent year-

over-year growth in sales, with VM-estimated total sales

of $2.620 billion for calendar year 2023.

A notable standout this year among Luxottica Retail

brands includes Pearle Vision, the largest optical fran-

chise business in the U.S., which has been recognized

once again in Entrepreneur's Franchise 500 list as the

#1-ranked health and wellness franchise in the country.

Closing 2023 with 510 locations, including 61 corporate

and 449 franchise, Pearle Vision had a record year, dem-

onstrating total revenues of approximately $550 million,

the company told VM.

Ten years ago, the company noted, its network was

50 percent corporate owned and 50 percent franchised;

it has since doubled down on its franchise model,

complete with support and tools to help owners and

independent ODs run a successful practice. Close to 90

percent of the company’s fleet is now franchised, and

the company indicates it has plans to open several new

locations in 2024.

Other businesses within the Luxottica Retail group

include LensCraers, with 932 total locations (including

95 LensCraers inside Macy’s). In 2023, LensCraers

launched its rst virtual experience, LensCraers Eye

Odyssey, on the global immersive platform Roblox, oer-

ing participants an online edutainment experience that

provides an engaging and educational way to promote

healthy eyecare habits. Season 2 of the experience was

launched earlier this year.

Target Optical operated 574 locations (an increase

of 12 stores) and saw sales increase to a VM-estimated

$525.6 million. Additional Luxottica Retail brands

include For Eyes (107 locations); Oliver Peoples (24 loca-

tions); Persol (1 location); Ray-Ban (33 locations); OSA (3

locations); and Alain Mikli (1 location).

In May 2022, EssilorLuxottica announced the launch

of OneSight EssilorLuxottica Foundation, and in 2023,

the foundation scaled up its global eorts to help elimi-

nate uncorrected poor vision, the company stated. In

collaboration with like-minded partners, the foundation

has provided 177 million people with permanent access

to vision care, dispensed more than 14 million pairs of

eyeglasses to those in need and established more than

4,900 permanent access points, bringing vision care to

areas where it was previously unavailable.

NATIONAL VISION

HOLDINGS, INC

National Vision (NASDAQ: EYE), one of the

largest optical retail companies in the U.S. with stores

in 38 states and Puerto Rico, ended 2023 with 1,413

U.S. optical locations, and a total U.S. optical revenue

of $2,126 million. National Vision operated under six

national retail trade names in 2023: America’s Best

Contacts & Eyeglasses, Eyeglass Word, Vision Center

brought to you by Walmart, Vista Optical in select Fred

Meyer stores, Vista Optical in select military exchanges

and AC Lens. The company did not report any acquisi-

tions or divestitures in 2023.

In the 2023 scal year, National Vision opened 70

new stores, closed seven stores and transitioned four

stores to Walmart. These transitions to Walmart were

part of the partnership termination; National Vision’s

partnership with Walmart Inc. ended in February 2024.

This partnership included supplying and operating Vi-

sion Centers in 229 Walmart stores, providing contact

lens distribution and related services to Walmart

and its aliate, Sam’s Club, and arranging for the

provision of optometric services at certain Walmart

locations in California.

In addition, in 2023 National Vision announced its

decision to wind down its AC Lens operations which

primarily supported the contact lens distribution and

related services to Walmart and its aliate, Sam’s Club.

For the 2023 scal year, the combined Walmart

Vision Center and AC Lens operations generated

approximately $403 million in revenue and earnings

before income tax of approximately $17 million. Eec-

tive as of Feb. 23, 2024, the company has completed

the transition of 229 Walmart Vision Center stores and

remains on-track with its plans to wind down its AC

Lens operations by June 30, 2024.

For the 52 weeks ending Dec. 28, 2024, the company

expects net revenue to be between $1.965 billion and

$2.005 billion. The company also expects to open 65 to

70 new stores in scal 2024, most in the America’s Best

brand, according to CEO Reade Fahs. The company an-

nounced that it will convert its 20 Eyeglass World stores

in California over to the America’s Best brand.

Continued on page 32

1 2

Download a PDF of VM’s complete 2024 Top 50 Report at www.VisionMonday.com

under the VM Reports category by clicking on Top 50 Retailers.

COVER TOPIC

Snapshots of Optical’s 10 Largest U.S. Retail Players

3

National Vision told Vision Monday, “National Vi-

sion’s greatest achievement in 2023 was that it was

another year of continued improvement to optometric

retention and a record year for optometric recruitment

coupled with the ongoing expansion of our in-house

remote optometric practice oering. In short, we were

able to provide increased access to the eye exams that

patients desire from us across the country.”

The company said, “National Vision continues to in-

vest in technology to expand patients’ access to eyecare

and oer greater flexibility to doctors.”

National Vision said it “Continues to pursue opportu-

nities to make quality care more aordable and acces-

sible, such as by investing in the development of AI tools

to analyze retinal images for biometric markers linked to

overall health risk factors, and America’s Best Contacts

& Eyeglasses becoming the rst national optical chain to

make retinal imaging an included part of comprehensive

eye exams for children.”

WALMART INC.

In its directly-managed optical business,

the departments at Walmart and Sam’s

Club totaled a collective number of 3,421 locations

in 2023. Sales increased from $1,880 million in 2022

to $2,025 million in 2023. VM estimates of Walmart’s

Inc.’s optical business includes the company-owned

and operated Walmart optical departments (2,875 lo-

cations as of the end of 2023) and Sam’s Club optical

departments (546 locations at the end of 2023).

In May of 2024, Walmart announced it would

close its 51 U.S. health clinics across ve states

and instead rearmed its commitment to its vision

centers and pharmacies. This focus on investing in

vision centers began in early 2023, when Walmart

announced it was raising wages and investing in ca-

reers for more than 7,000 opticians and pharmacists

across its locations.

“Through our experience managing Walmart Health

centers and Walmart Health Virtual Care, we deter-

mined there is not a sustainable business model for us

to continue,” the company said in an announcement.

“This is a dicult decision, and like others, the chal-

lenging reimbursement environment and escalating

operating costs create a lack of protability that make

the care business unsustainable for us at this time,”

the announcement said.

In February 2024, optical retail chain National Vi-

sion completed the transition of 229 Walmart Vision

Center stores as part of the conclusion of its 34-year

partnership with the company. Walmart also launched

a suite of optical tools, including virtual try-on capa-

bilities, in January 2024.

EYECARE PARTNERS LLC

EyeCare Partners, a portfolio company

of Partners Group, ended 2023 with 682

ECP-aliated locations consisting of ophthalmology

and optometry oces. The PE-backed group nished

the year with 314 MDs and 745 ODs under their

umbrella, with corporate total U.S. optical revenue of

$1.728 billion consolidated from clinically integrated

operations.

While the company made no public disclosures re-

garding acquisitions or divestitures in 2023, it did open

the Cincinnati Eye Institute Retina Clinic at The Landings.

According to a company executive, its singular focus on

medical and surgical treatment of the retina is the larg-

est of its kind, and the site is unique with state-of-the-art

retina equipment, including the most advanced imaging

platforms available. The site also supports expansion of

clinical trial and research services.

EyeCare Partners’ growing network of 1,000+ doc-

tors and team members served more than 3.5 million

patients across 18 states in 2023, according to company

executives, leveraging its physician-led model of clini-

cally integrated eyecare, along with innovation and

research advancements.

Chris Throckmorton was named as chief execu-

tive ocer at EyeCare Partners in late January 2024,

succeeding the role held by Ben Breier as interim CEO.

Other leadership appointments followed this year, with

Joel Day named as executive vice president of nance

and chief nancial ocer, eective June 1, 2024. In April

2024, the company appointed Mark Barron as chief

growth ocer.

For the duration of 2024, EyeCare Partners plans to

stay assertive in seeking out opportunities that “best

t its vision.” Company executives told VM in April,

“EyeCare Partners will remain aggressive on opportu-

nities that t our long-term strategic vision and reflect

appropriate valuations in this inflated cost environ-

ment. We also remained focused on new clinic and

ASCs builds, site expansions, innovation and other

strategic growth initiatives.”

COSTCO OPTICAL

Part of Costco Wholesale (NASDAQ: COST),

Costco Optical ended 2023 with 568 U.S.

optical locations, an increase of 13 compared with its

555 U.S. locations at the end of 2022. Costco Optical

also reported a corporate total U.S. optical revenue of

$1,683.9 million.

Costco Wholesale is a worldwide business. Ron Vachris

was appointed to the role of CEO, eective January 1, 2024.

Costco Optical did begin oering remote or tele-

optometry exams prior to 2023 and intends to expand

those eorts in 2024, company executives said.

CAPITAL VISION SERVICES

DBA MYEYEDR.

MyEyeDr. nished 2023 with a total of 842

oces, 1,481 doctors, and $1,400.0 million in revenue.

Executives told VM in April, “MyEyeDr. spent much

of 2023 focusing on integrating the 200 practices we

acquired in 2021 and 2022. We took the time to ensure

the patient, doctor and associate experience was up to

MyEyeDr.’s standards. We partnered with 10 additional

practices in 2023 and accelerated our practice acquisi-

tions and integrations through the fourth quarter of 2023

and into 2024.”

The senior leadership team at MyEyeDr. also said

the organization will continue to integrate technology

and service operations, invest in clinical excellence and

training, and accelerate its acquisition activities in 2024.

MyEyeDr. co-founder and CEO, Sue Downes, said,

“Investors continue to be interested in vision care due

to the stability of the sector. With consistent global

turbulence over the last four years, optometry and the

optical industry remains strong and growing.”

Downes also told VM, “From an acquisition per-

spective, we plan to accelerate activity, and partner

with new practices at a rate similar to our pre-COVID

time frame. We will also grow in selected markets

by opening 10 locations as ‘cold‘ We continue to

strengthen our class-leading patient experience by

making signicant investments in medical equipment

and practice management technology.

“We have plans to support and promote our doctors’

medical and specialty practices in new and exciting

ways in 2024, while better meeting our patients’ needs

through omni-channel expansion,” Downes said.

Continued from page 30

JUNE 2024 VISIONMONDAY.COM

Facebook.com/VisionMonday

@VisionMonday

Snapshots of Optical’s 10 Largest U.S. Retail Players

Continued on page 34

5

COVER TOPIC

6

7

4

32

VISIONWORKS OF

AMERICA, INC.

Visionworks of America, a VSP Vision

company, unied its stores across the U.S. under the

Visionworks name. It closed 2023 with 773 loca-

tions and revenues of $1,173.0 million. Online sales

accounted for $2.3 million, mostly in contact lenses

(76.7 percent) and in eyeglasses (21.9 percent). VSP

Vision acquired Visionworks in October 2019.

In 2023, the company said it “continued simplify-

ing the customer journey by creating an experience

that is straightforward and hassle free.” This included

its online scheduling tool and comprehensive exams

that include retinal imaging in all Visionworks loca-

tions. The company also noted that it completed

its rst full year of organizing its frame selection by

shape and price, along with a seamless checkout

process, complete with digital order tracking. The

company also oers a 100-day guarantee on all

purchases.

In 2023, the company said it focused on store

expansion in California and Washington state. It also

introduced the Visionworks brand into three markets

with multiple retail locations.

Visionworks continued to employ some remote

exam/tele-optometry technology in its group prior to

2023 and said it expects to expand that this year.

WARBY PARKER

Warby Parker (NYSE:WRBY) ended 2023,

its second full year as a public company,

with 237 stores across the United States and Canada,

including 40 stores opened during the year. Full-year

net revenue was reported at $669.8 million, includ-

ing both online sales and those from North Ameri-

can storefronts. Warby Parker operated 5 stores in

Canada. VM estimated that the company's U.S. sales

for the year ended 12/31/24 were $659 million.

“2023 marked our second full year as a public com-

pany and one in which we executed on our commit-

ment to growing sustainably, delivering double-digit

revenue growth each quarter while improving margins

and creating exceptional customer experiences,” said

co-founder and co-CEO Neil Blumenthal.

Warby Parker ended 2023 with $216.9 million in

cash and cash equivalents. The company also entered

into a new $120 million revolving credit facility with

JPMorgan Chase Bank, N.A., Citibank, N.A., and

other lenders from time to time party thereto, which

remains undrawn, the company said.

In January 2023, VM reported that for the third

consecutive year, 20/20 Onsite, a leading provider

of on-site vision care, partnered with Boston Public

Schools, the New England College of Optometry and

Warby Parker to provide free vision screenings, eye

exams and glasses to Boston public school children.

The program, called Vision for Boston, brought eyec-

are to students in their schools.

Warby Parker has designed a line of glasses

specically for students that are part of this program

through Warby Parker’s Pupils Project initiative.

“Warby Parker created Pupils Project in 2015 to

eliminate barriers to vision care access in schools

across the country, while also helping students feel

excited by and condent in their glasses," said Dave

Gilboa, co-founder and co-CEO of Warby Parker.

"Since then, we’ve seen the positive impact that

prescription eyeglasses have on students’ learning

experiences. We’re excited to continue this impor-

tant work in Boston alongside our Vision for Boston

partners.”

In February 2024, Warby Parker expanded its

relationship with Versant Health, Inc., a wholly-owned

subsidiary of MetLife, Inc., and one of the nation’s

leading administrators of managed vision care. This

expansion will bring an additional 15 million lives

in-network with Warby Parker, nearly doubling the

number of lives with in-network access to Warby

Parker to more than 34 million. The company expects

members under these plans to be able to access their

in-network benets later this year.

“Looking to 2024, we’re excited to meet millions

of customers where and how they want to shop as

we expand our retail presence, deploy disciplined

marketing spend to support growth across our om-

nichannel experiences, and nearly double the number

of insured lives who can use their in-network vision

benets with Warby Parker to over 34 million individu-

als,” added Gilboa.

AEG VISION

Company executives said AEG Vision

continued its steady growth in 2023

generating +6 percent comp sales in their base prac-

tices along with strong earnings growth. Seventy-ve

new practices were added and integrated onto AEG

Vision’s common platform, the company said. Today,

95 percent of the practice network is on a common

platform that includes technology, product supply

chain and signicant back-oce support, AEG told

Vision Monday.

AEG Vision nished calendar year 2023 with 425

practices. The company, backed by Riata Capital

Group, ended 2023 with revenues of $650 million and

moved to number 10 on the VM Top 50 U.S. Retailers

Chart.

“We have grown steadily during the past three

years, adding between 70 to 90 practices annually,”

Eric Anderson, CEO of AEG Vision, told Vision Monday

in April of this year. “Our acquisition activity has

not been impacted by external factors and we have

not experienced any lack of interest from potential

sellers.”

The company’s community of 4,000 doctors and

associates allows it to deliver elevated levels of

eyecare to more than 2 million patients each year,

Anderson noted. “Our business strategy remains

unchanged, given the success we have experienced,”

he said. “We look to partner with leading optom-

etrists across the U.S. who wish to elevate their

practice. We make signicant investments in each

practice (e.g., technology, equipment, back-oce

support) that elevate outcomes for all of our doctors,

associates and patients,” Anderson said.

Looking ahead for the remainder of 2024, AEG

Vision is planning to stay the course, searching for

partnership opportunities while helping optometry to

meet its goals along the way, Anderson said. “In 2024,

we plan to continue the same steady growth we have

demonstrated over the past several years,” he noted.

“Our goal is to continue to help elevate optometry

wherever we operate—while maintaining the strong

positive culture that has been the cornerstone of our

success.” n

JUNE 2024

Continued from page 32

9

10

Snapshots of Optical’s 10 Largest U.S. Retail Players

COVER TOPIC

8

Download a PDF of prior years of VM Top 50 U.S. Optical Retailer Reports and analysis at

www.VisionMonday.com under the VM Reports category by clicking on Top 50 Retailers.

34